America 2030

6-Year Secondary Fund, Investing in Defence, Energy, and AI

Investing in high-growth Series B+ startups shaping national security

Typical investment: 1-3.5 million per company, targeting a portfolio of up to 30 companies

Track record: Selected Fund I investments achieved a TVPI of 2.7, outperforming the Carta 2020 vintage by 2.5x

Minimum investment of 50,000

Accepting investments via self-directed IRAs.

Why Choose Us

Focus

With selected European opportunities

High-growth scaleups and Series B+ startups with established secondary market

Liquidity

Defense, Energy, Cyber and AI investments in Fund I achieved a TVPI of 2.9, outperforming the Carta 2020 vintage by 2.7x

$1-3.5 million per company, targeting a portfolio of up to 30 companies

Diversification

Track record

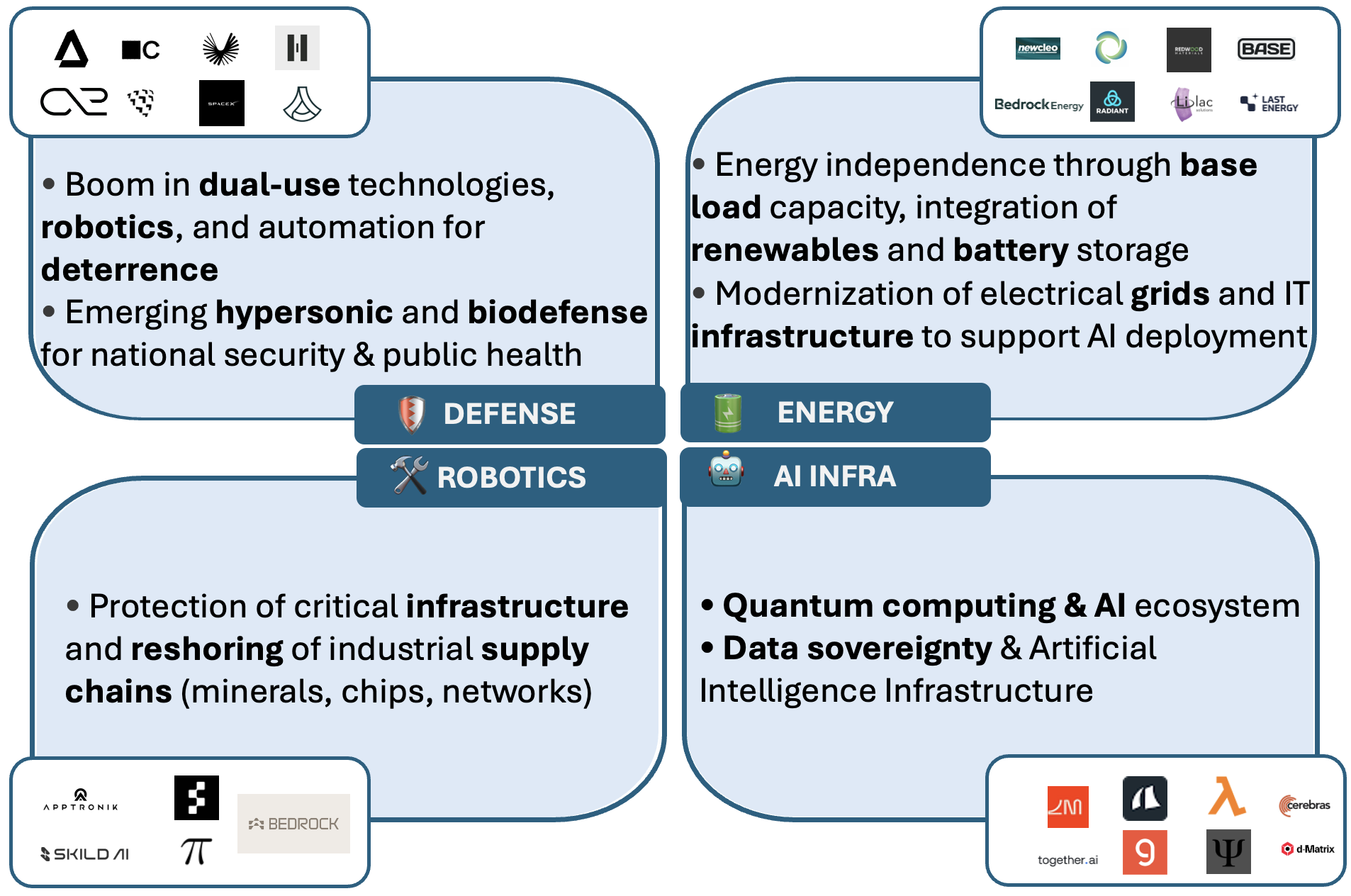

Investing in Resilience for Scalable Impact

A strategic focus on national interests, including defense, security, data and energy, since 2020

Where We Focus

Meet the Team

Learn More About America 2030

Be part of a high-conviction investment strategy focused on defense, energy, and dual-use technologies. Backed by decades of experience and a strong track record of exits and returns, our team is ready to help you access tomorrow’s defining opportunities today.

Invest through your IRA – America 2030 accepts investments via self-directed IRAs. Speak with your IRA custodian or financial advisor to determine your eligibility and investment process.