AI Infrastructure Startups: The Emerging Leaders Reshaping Compute, Data, and Robotics

The Competitive Landscape of AI & Deep Tech Startups (2025)

As the AI boom accelerates, we are closely tracking infrastructure startups building the backbone of next-gen machine intelligence. From custom silicon and cloud compute to quantum processors and robot brains, these startups are segmented into five high-impact categories. Below, we analyze competitive clusters, go-to-market strategies, and emerging winners for secondary venture capital investors seeking liquidity exposure before IPO.

Based on America 2030 Model Portfolio, several AI startups can be grouped into competitive clusters based on their core business focus. Below is a structured breakdown of the key sectors and rivalries shaping the landscape.

1. AI Hardware & Accelerator Chips

These firms design specialized processors to optimize AI model training and inference. These players compete on performance, cost, and energy efficiency, particularly targeting AI workloads across cloud, enterprise, and hyperscaler markets:

Key Insight: Cerebras stands apart with its wafer-scale engine, a differentiated approach to massive AI model training, while Groq focuses on ultra-fast low-latency inference, appealing for real-time applications like autonomous systems and GenAI.

Companies already under coverage at America 2030:

2. AI Cloud Compute Providers

Firms offering GPU-based or alternative compute infrastructure for training and deploying AI models. A fast-growing segment with demand driven by LLM and generative AI model training:

Key Insight: Lambda, a YC alum, has gained traction with its developer-first GPU cloud offering and long waitlist for reserved compute access. Tensorwave is capitalizing on AMD’s AI chip momentum as an alternative to Nvidia-reliant stacks.

3. AI Data & Integration Platforms

Companies addressing the data infrastructure behind AI training and deployment. Data preparation remains a critical bottleneck for AI. These firms serve customers with large or complex data environments.

Key Insight: While Scale AI gained early government and DoD traction, Nexla is making inroads with scalable enterprise data integration across verticals. Both firms are critical to unstructured data workflows.

4. Robotics & Physical AI

Unique positioning in applying generalist AI to physical systems across environments:

Key Insight: Physical Intelligence operates in a unique white space, offering generalized AI control for robotics, a nascent but fast-developing segment especially relevant to logistics and defense automation.

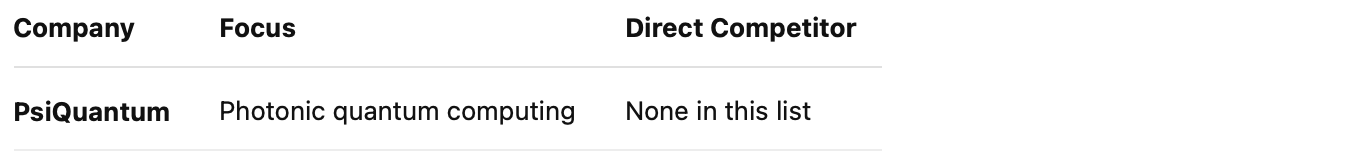

5. Quantum Computing

Operating in a distinct deep tech category, focused on long-term computing breakthroughs:

Companies already under coverage at America 2030:

Key Insight:

PsiQuantum’s use of photonic qubits and billion-dollar funding make it the most well-capitalized bet in quantum hardware. Its potential to deliver a fault-tolerant quantum computer is years away, but its cap table includes top-tier institutional VCs and sovereign wealth funds.

Another company we monitor in our Model Portfolio is Armada. It specializes in edge computing infrastructure, providing ruggedized, modular data centers known as “Galleons.” These mobile units are designed for deployment in remote or challenging environments, offering localized computing power and AI capabilities. Armada’s solutions are utilized across various sectors, including defense, mining, and logistics, to enable real-time data processing and connectivity at the edge.

Future Outlook

The AI infrastructure stack remains one of the most investable areas of deep tech, with trillion-dollar implications across cloud, chips, and robotics. Secondary investors should focus on companies that:

Have real customer traction (Groq, Lambda, Scale AI).

Target vertical AI workflows (e.g., Nexla, Physical Intelligence).

Are positioned to benefit from Nvidia platform fatigue.

Expect more secondary liquidity windows in 2025 as growth-stage VCs seek partial exits and sovereign wealth funds enter the late-stage rounds.

Stock Picking vs. Mandating an Expert

For investors unsure which specific company to back in the rapidly evolving AI infrastructure landscape, America 2030 offers a diversified alternative. This six-year, actively managed secondary fund targets high-conviction positions in AI infrastructure startups from Series B onward—spanning hardware, cloud compute, robotics, and quantum. By investing in America 2030, investors gain exposure to a curated portfolio of late-stage private companies driving the backbone of the AI revolution, with reduced single-company risk and potential access to discounted secondary shares.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.