Epic Games' Legal Clash with Google

Epic Games, initiated a high-stakes legal battle against Google, challenging the tech giant's stronghold over the mobile application marketplace.

This lawsuit follows Epic's previous lawsuit against Apple, bringing to light the contentious issue of the significant fees both companies charge for transactions within their respective app stores. Epic's litigation aims to break what it perceives as an unfair monopoly, seeking to introduce alternative payment systems that could potentially reduce consumer costs.

Epic Games, renowned for their blockbuster game Fortnite, argues that the hefty 15% to 30% transaction fees imposed by Apple and Google's platforms are excessive, dubbing them the "Apple tax" and "Google tax." By advocating for direct payment options, Epic contends that it could offer lower prices and more choices for both players and developers. However, Apple and Google argue that their practices are necessary to maintain a secure ecosystem.

The ongoing legal dispute termed Epic v. Google has already witnessed both companies presenting their opening arguments. The trial is poised to delve into the intricate aspects of antitrust laws and may have far-reaching implications for the technology sector, app developers, and customers.

We closely monitor these developments as a platform providing pre-IPO access to Epic Games shares. The outcome of this trial could significantly impact Epic Games' valuation and the broader mobile app market. Our platform allows investors to partake in the potential upside of Epic Games' quest to reshape the digital marketplace before their public offering. This trial underscores the company's commitment to innovation and fair competition, characteristics that could make Epic Games an attractive investment opportunity.

Investors interested in pre-IPO opportunities in companies like Epic Games should consider the potential implications of such high-profile litigation on the company's future market position and financial health. As the trial progresses, we will continue to provide our clients with the latest insights and analysis, ensuring they are well-informed to make strategic investment decisions in this dynamic and evolving sector.

Epic Games stock price

Description of Epic Games Stock Price Movement

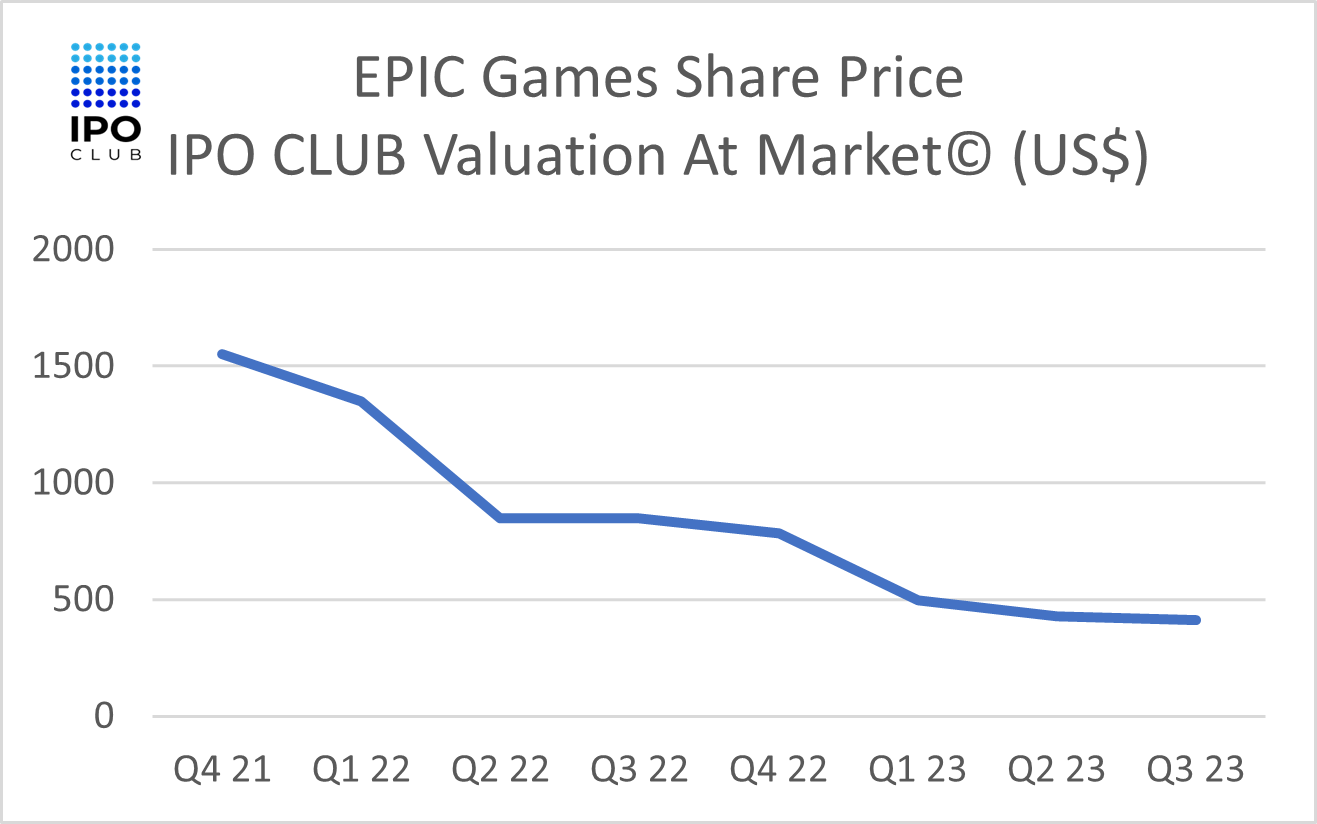

Starting in Q4 2021, Epic Games' stock was valued at approximately $1,500. As we transitioned to Q1 2022, there was a noticeable decline, bringing the valuation down slightly above $1,000. This downward trend continued with a more gradual slope through Q2 2022 to Q4 2022, with the stock's value stabilizing around the $500 mark. From Q1 2023 to Q3 2023, the price movement shows a relatively flat line, suggesting that the stock price has found some stability and consolidation around the $500 level.

wHY WE LIKE EPIC GAMES stock AT THESE LEVELS

Stabilized Price Point: The stock has shown relative stability over the last three quarters, hovering around the $500 mark. This consistency suggests that the stock might have found its bottom, which traditionally indicates a lesser risk of further significant decline.

Historical Highs: Considering the stock once traded at around $1,500, the current price of $500 may be perceived as undervalued, especially if the company's fundamentals remain strong and its restructuring strategies are expected to bear fruit in the long run.

Strategic Changes: With Epic Games' recent announcements of restructuring, divestments, and other strategic shifts, there's a possibility that the company is positioning itself for a rebound. Successful restructuring can often lead to cost savings and more efficient operations, potentially driving future profitability and, by extension, share price appreciation.

Fortnite's Potential: As Fortnite continues its evolution towards a metaverse-inspired ecosystem, any success in this venture can provide significant growth opportunities for Epic Games, which could reflect positively on its stock price.

Epic Games IPO

The share price movement and strategic decisions made by Epic Games can provide insights into the potential timing and strategy behind its IPO. Here's an analysis based on the presented data:

Stabilizing Share Price: The stabilized share price around the $500 mark over several quarters suggests Epic Games may look for a more stable valuation before considering an IPO. Companies often seek to go public when they believe their stock is at a fair or attractive valuation to raise the maximum amount of capital.

Strategic Restructuring: The layoffs, divestments, and spin-offs highlight that Epic Games is taking steps to strengthen its financial position and streamline operations. Such restructuring moves are often seen in companies gearing up for an IPO, aiming to present themselves in the best financial light to potential investors.

CEO's Statement: Tim Sweeney's acknowledgment of financial challenges and the company's steps to address them can be viewed as a move towards transparency. Such transparency is vital for a company considering going public, as it will face scrutiny from regulators, analysts, and potential shareholders.

Market Reception: While the share price has declined from its highs, the stabilization suggests that the market has absorbed most of the company's recent news. If Epic Games can showcase a promising trajectory in its operations and financials in the coming quarters, it may find a receptive market for its IPO.

More info on EPIC Games stock? subscribe to our club letter

CONCLUSION

Today, Epic Games is one of the world's largest independent publishers with full-stack potential—with its own games, the Epic app store, the Unreal game engine, and the metaverse, based on its blockbuster game # Fortnite.

It trades around 3.3x 2023 projected revenues. As a comp, Activision was acquired at an 8x multiple, Roblox is trading at 9x, and Unity at 6x.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.