Flexport cuts staff to gain profitability

In a recent communication to its workforce, Flexport, the digital freight forwarder, announced a staff reduction of approximately 20%, amounting to approximately 600 employees out of its 3,300-strong workforce.

Notably, these layoffs follow a prior round of workforce reduction by the company, where 20% of its global workforce was let go nine months earlier.

Moreover, these developments coincide with the unexpected departure of then-CEO Dave Clark, who left Flexport due to disagreements regarding the company's strategic direction.

Flexport has opted not to provide any official comment on the specific reasons behind these layoffs.

Rick Watson, CEO and founder of RMW Commerce Consulting, suggests that a significant portion of the layoffs may be attributed to the Deliverr fulfillment technology acquired by Flexport from Shopify or may involve personnel hired during Clark's tenure. Several executives who followed Clark from Amazon to Flexport, including President and Chief Commercial Officer Teresa Carlson, left the firm following his departure.

Watson had previously expressed that Flexport, valued at $8 billion, might be overvalued when Clark departed. Following these layoffs, Watson opines that Flexport faces a formidable challenge ahead. He questions the company's ability to simultaneously excel in the low-margin freight shipping business, focus on capital lending, and serve as a prominent North American virtual logistics network for its partner Shopify, all while navigating a challenging economic landscape characterized by reduced inventory and high interest rates.

The layoffs align with the agenda set by Flexport's leadership, led by its founder, to return the company to profitability and leverage its substantial $1 billion net cash reserves without resorting to price increases. Notably, a report by The Information in September had indicated a sharp 70% drop in Flexport's revenue during the first half of 2023, primarily due to lower-than-expected shipment volumes and declining freight rates.

In addressing these developments, Flexport's CEO emphasized the commitment to maintaining a high standard of customer experience, as expressed through conversations with the company's top customers. A recurring theme in Flexport's leadership discussions has been prioritizing customer service, acknowledging a period when the company may have deviated from this focus.

In the public statement, Flexport's leadership indicated its intention to refocus on key performance indicators linked directly to customer experiences, such as on-time execution, quote-to-invoice accuracy, shipment milestone accuracy, direct customer feedback, and net promoter scores.

Despite emphasizing returning to its core freight business, Flexport's leadership reaffirmed its dedication to its long-term technological vision. They underscored the potential for technology to enhance on-time performance, reliability, compliance processes, and cost savings within the global supply chain.

Recently, Flexport unveiled two significant initiatives: Revolution, an end-to-end supply chain platform targeting small and medium-sized businesses, and Flexport+, a monthly membership program priced at $149. The former, described as "TurboTax for importing and selling goods" by Flexport's CEO, was introduced on the same day as a similar offering by Amazon known as "Supply Chain by Amazon."

Flexport has outlined a severance package for affected U.S. employees that includes nine weeks of severance pay, extended healthcare coverage for two months through the end of the year, and immigration support. Exit support for laid-off employees in other geographic regions is expected to vary, with specific information to be communicated upon notification of termination. The company is also actively working with recruiters to assist departing employees in finding new job opportunities and collaborating with over 300 companies to facilitate such transitions.

For more coverage about Flexport ipo, subscribe to our club letter

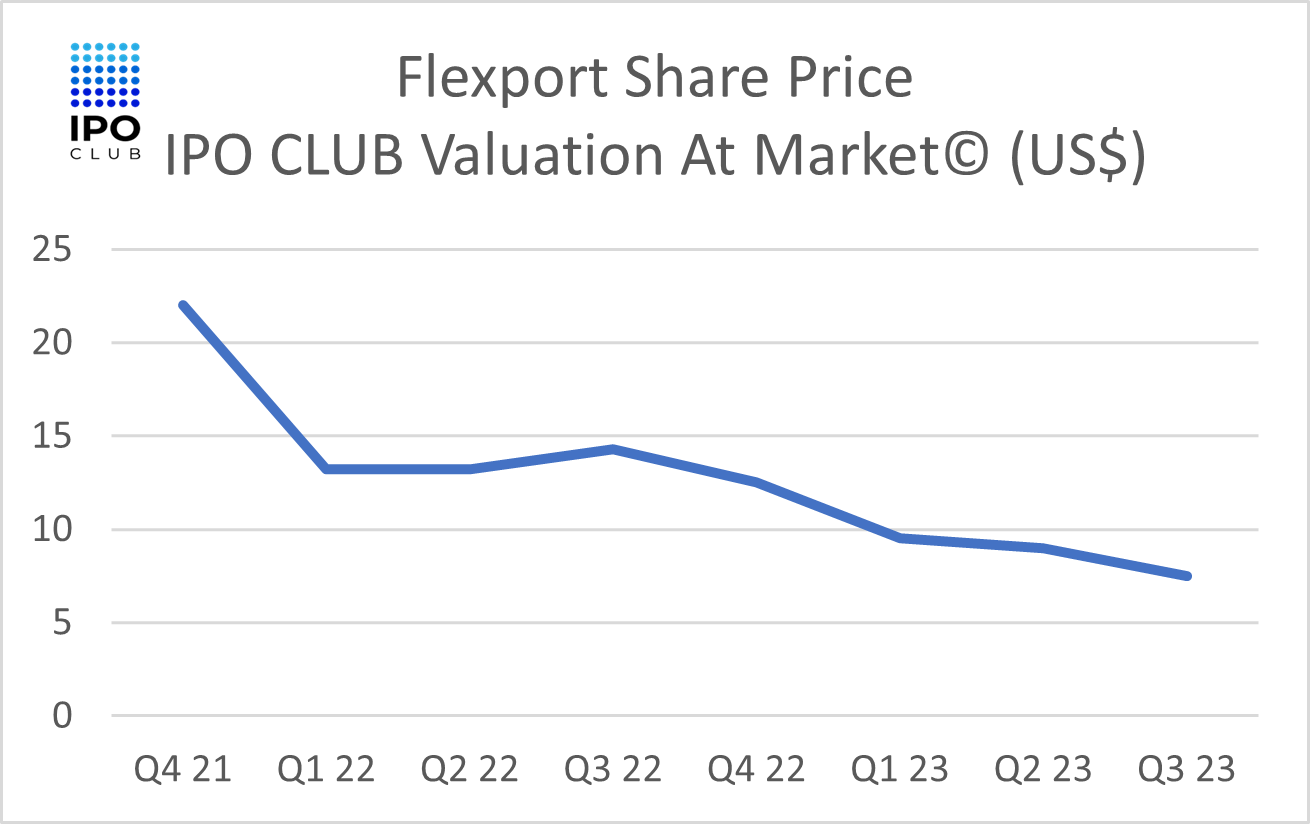

Flexport stock price

From Q4 21 to Q1 22, there is a sharp increase in Flexport's share price, peaking slightly above 20 (US$). This indicates a bullish period where the stock price appreciated significantly.

Following that peak in Q1 22, the share price starts to decline gradually. From Q1 22 to around Q3 22, there is a moderate decrease, and the stock price seems to stabilize briefly.

However, post-Q3 22, the decline continues more pronouncedly, reaching its lowest point in Q3 23, which is just above 5 (US$). This suggests a bearish trend where the stock value has depreciated over the time frame.

In summary, after an initial surge, Flexport's share price has shown a declining trend over the observed quarters.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.