Instacart IPO: CARROT OR STICK?

Instacart is set for a September IPO on Nasdaq, potentially revitalizing the 2023 US IPO landscape.

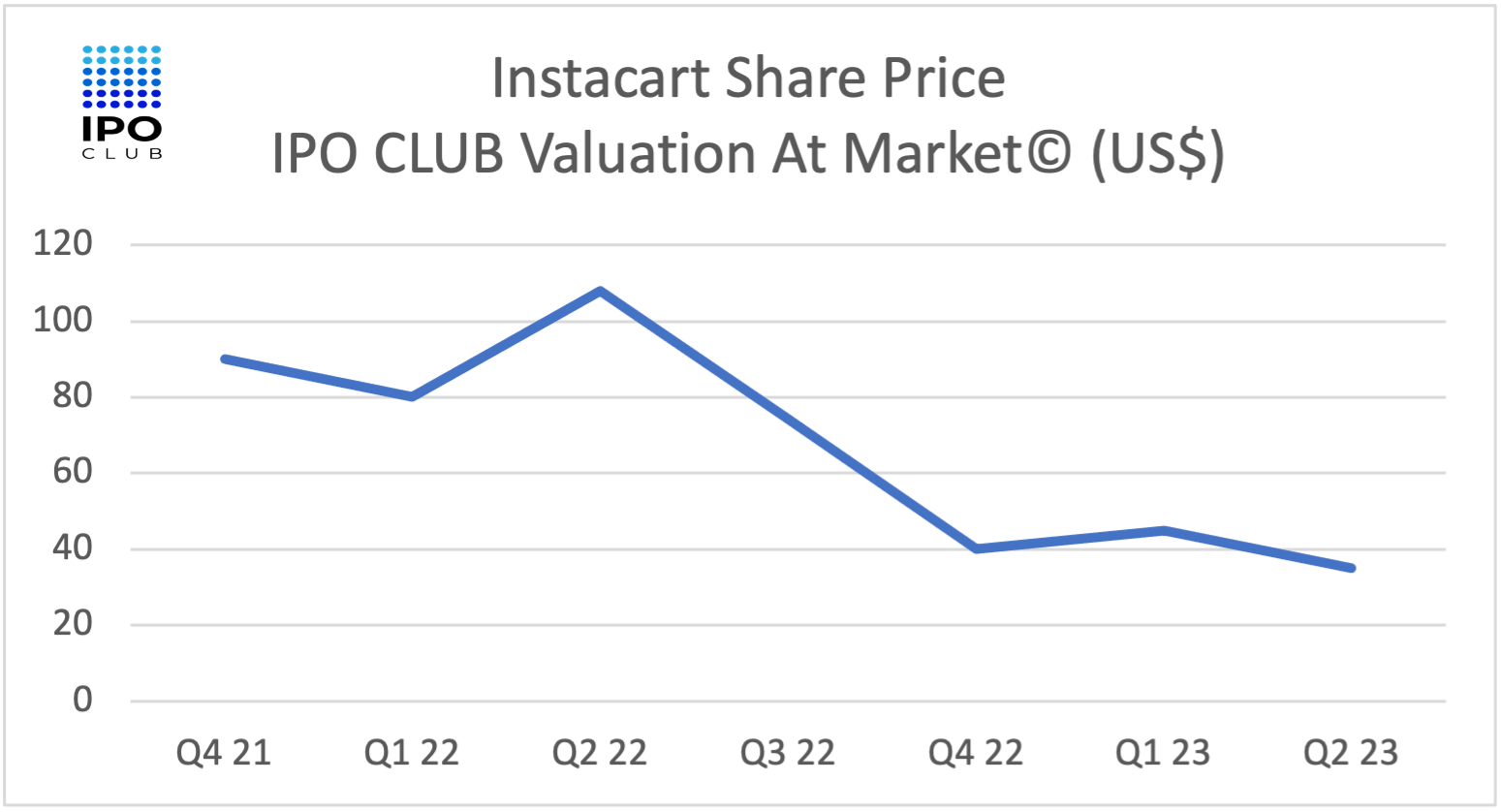

But if you bought the stock at 2021 prices, how happy can you be about the IPO?

One of the most anticipated moves in the IPO landscape is materializing as Instacart Inc., the leading online grocery delivery firm in the US, prepares for its September IPO on Nasdaq. This decision follows its earlier contemplation of a direct listing. Sources, choosing to remain anonymous due to the confidentiality of the information, suggest that the company's public filing could be unveiled to the US Securities and Exchange Commission within a week.

A Refreshing Wave in the IPO Market

Instacart's decision to list could reinvigorate a somewhat inconsistent IPO market this year. Other companies eyeing a listing next month include chip manufacturer Arm Ltd., which boasts significant ownership by SoftBank Group Corp. Arm Ltd. is poised to raise a staggering $8 to $10 billion, setting it up as 2023's potential blockbuster IPO. Another notable mention is Klaviyo, a marketing and data automation titan, expected to disclose its financials shortly. However, both Klaviyo and Instacart remain tight-lipped on their respective IPO proceedings.

A Glance at Current IPO Dynamics

2023 presents a contrasting picture compared to the previous year, with only $14 billion garnered from IPOs on US exchanges. This is a sharp dip from the phenomenal $241 billion recorded at the same juncture in 2021.

Unveiling Instacart’s Financial Trajectory

As part of its IPO preparation, Instacart will soon disclose its financial health and operational intricacies. Though initial filings may not disclose intricate offering details, subsequent documents will delineate the intended size and pricing strategy.

Last year, whispers of Instacart's confidential filing with the SEC for a public listing gained traction. Renowned banking institutions like Goldman Sachs Group Inc. and JPMorgan Chase & Co. were believed to be partners in this journey. Concurrently, Instacart pursued strategic measures to fortify and amplify its dominance in the online grocery delivery realm.

A Brief Dive into Past Valuations and Investments

In light of turbulent market conditions, Instacart prudently deferred its listing plans in the past. Reflecting on this, Instacart's CEO, Fidji Simo, once mentioned the unlikely possibility of a 2022 IPO owing to "extremely tumultuous" market dynamics.

Subsequently, internal valuations witnessed adjustments, dropping figures from $24 billion to a revised $13 billion. In its startup phase, Instacart amassed a commendable $2.74 billion. Its valuation in 2021 was pegged at a whopping $39 billion. The company's esteemed investor list includes Tiger Global Management, Coatue Management, and D1 Capital Partners.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.