SMR Stock Report

October 2025 Update

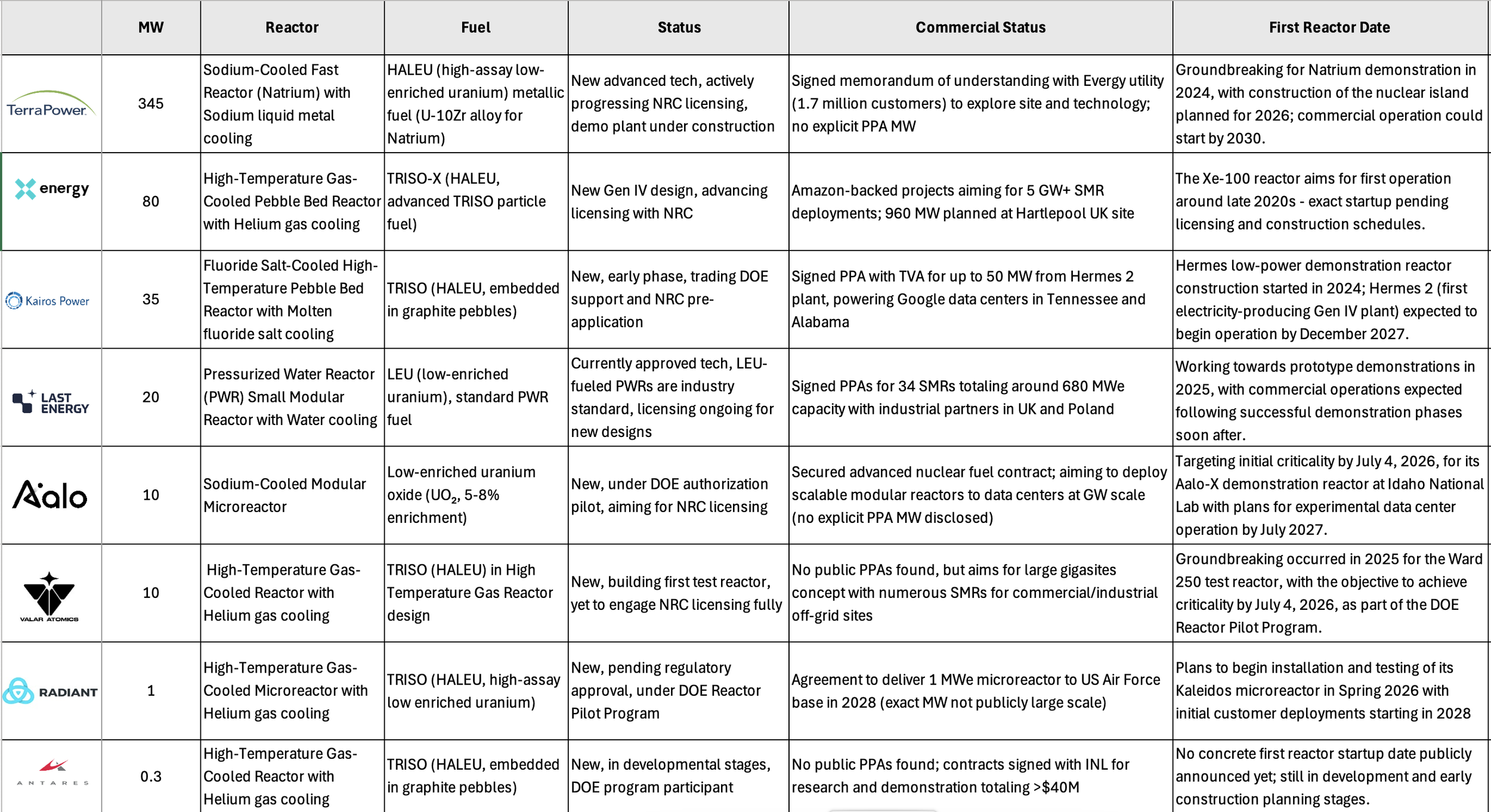

SMR and Microreactor Magnificent 7

Definitions

SMRs: Typically sized from about 20 MWe to several hundred MWe, these reactors are modular, factory-built, and target utility-scale power generation. Examples: TerraPower, X-Energy, Kairos Power, Last Energy, Antares.

Microreactors: Significantly smaller (usually below 20 MWe, commonly 1-10 MWe), they are designed for remote deployment, military, industrial, or specialized commercial uses, often with enhanced portability and quicker deployment. Examples: Radiant Nuclear, Aalo Atomics, and Valar Atomics.

2025 is a landmark year for advanced nuclear. Discover our new industry report and chart highlighting the private SMR and microreactor startups shaping the future of energy—who’s raising billions and racing to deploy next-generation technology.

Executive Summary

Meet the Magnificent 8:

• TerraPower: Pioneering sodium-cooled fast reactors to deliver scalable, carbon-free grids and energy security.

• X-energy: Advanced Xe-100 SMR and TRISO fuel for safer, more versatile nuclear power that meets tomorrow’s needs.

• Radiant Nuclear: Zero-emissions, portable microreactors for military and commercial reliability.

• Last Energy: Plug-and-play modular PWRs, redefining speed, cost, and flexibility for new nuclear projects.

• Kairos Power: Building fluoride salt-cooled reactors with accident-resistant fuel; backed by Google and TVA, targeting utility-scale demonstration and commercial rollout by 2030.

• Antares: Deployable microreactors powering remote infrastructure and space missions with clean, reliable energy.

• Aalo Atomics: Commercializing advanced small fission reactors for affordable, scalable clean power and next-gen industry.

• Valar Atomics: Creating “Gigasite” industrial campuses powered by high-temperature gas reactors—grid-independent, clean energy for heavy industry, hydrogen, and data centers.

Candidates for America 2030 Investment

TerraPower

• Valuation: $3.8 billion as of the last major funding round in November 2022, confirmed by secondary listings and investor interviews.

• Funding: Closed $650 million in June 2025, lead investors include NVIDIA, Bill Gates, and HD Hyundai. Remains a private company.

• Project Milestone: Kemmerer, Wyoming demonstration plant under construction since June 2024; commercial start now projected for 2030 after permitting delays.

• Reactor Type/Fuel: Natrium (sodium-cooled fast reactor), using HALEU (U-10Zr alloy for core fuel).

X-Energy

• Valuation: Estimated at $600 million+ as of 2023; new $700 million Series C-1 raised February 2025 with Amazon, Jane Street, Ares and others.

• Project Milestone: Xe-100 demo project underway. Contracts for up to 5 GW of SMR deployments across Amazon sites confirmed.

• Reactor Type/Fuel: High-temperature gas-cooled pebble bed reactor (HTGR), TRISO-X fuel, Gen IV safety features.

Kairos Power

• Valuation: Not publicly disclosed for 2025; estimated in the $400M–$650M range from comparable size/funding. Significant commercial deal with TVA and Google announced August 2025.

• Project Milestone: Hermes demonstration reactor, utility deals, DOE grant participant.

Radiant

• Valuation: $645.2 million, confirmed by Series C-2 round on May 28, 2025.

• Funding: $165 million raised in Series C. Investors: Align Ventures, Ark, DCVC, and others.

• Project Milestone: Portable microreactors, first Air Force deployment contract for 2028.

Antares Nuclear

• Valuation: $275 million post-money at Series B-1 in September 2025.

• Funding: Raised $48 million in this round.

• Project Milestone: Pre-IPO, contracts with INL for R&D and demonstration.

Aalo Atomics

• Valuation: Not yet public; $100 million Series B raised August 2025, total funding at $136 million.

• Project Milestone: First demo reactor scheduled at Idaho National Lab for July 2026

Three New Entrants

Kairos Power is a mission-driven engineering and nuclear technology company commercializing advanced fluoride salt-cooled high-temperature reactors (KP-FHR) that combine accident-resistant fuel with low-pressure coolants for grid-scale, affordable, and safe clean energy; its rapid prototyping and partnerships (including Google and TVA) position it as a front-runner in next-generation SMR deployments aiming for U.S. demonstration and commercial rollout before 2030.

Valar Atomics is pioneering a new model for nuclear power with high-temperature gas reactors (HTGR) integrated into massive “Gigasite” industrial campuses, enabling production of hydrogen, data center power, and synthetic fuels at scale; their vertical approach sidesteps utility bottlenecks and aims to deploy and operate hundreds of reactors for grid-independent, clean heavy industry.

Adding a new dimension to the U.S. SMR race is European startup Newcleo, which has signed a strategic partnership with U.S.-based Oklo alongside Swedish firm Blykalla. This collaboration includes up to $2 billion in newcleo-led investment to build advanced nuclear fuel fabrication and manufacturing facilities in the U.S., aiming to strengthen transatlantic energy security and foster a closed-loop fuel cycle. Newcleo’s entry signals growing international competition and collaboration in advanced nuclear, accelerating America’s path toward energy independence with next-gen reactor fuel innovations.

August 2025 Update

IPO CLUB SMR Investment Analysis

Executive Summary

Based on comprehensive analysis of Radiant Technology, X-energy, Last Energy, NuScale and TerraPower, this report provides a structured investment framework and strategic recommendations for SMR technology investment. The analysis reveals significant differentiation in market positioning, technology maturity, and risk-return profiles across these four companies.

Market Overview

Between 2020 and 2025, AI infrastructure in the United States expanded rapidly as companies moved workloads to the cloud and generative AI emerged as a major driver of demand. By 2025, about one-third of all global data center capacity was already dedicated to AI workloads. Looking ahead, that share could approach 70% by 2030 as AI-native applications spread across industries. McKinsey estimates nearly 6.7 trillion dollars will be spent on global data centers by 2030, with more than 2.7 trillion of that in the U.S. Domestic demand is expected to keep rising 20 to 25% each year, putting continuous pressure on chip supply, the power grid, and available land. The main drivers of this growth include the massive computing needs of training large language models, the scaling of inference workloads as applications move into production, the broader digitalization of enterprises, and federal and state incentives for semiconductors and energy infrastructure.

Comparative Company Analysis

Technology Differentiation

Radiant Technology focuses on 1 MWe portable microreactors using TRISO fuel, targeting military and remote applications with mass production goals of 50 units annually. The company has secured HALEU fuel allocation and plans testing at Idaho National Laboratory in 2026.

X-energy develops 80 MWe high-temperature gas-cooled reactors using TRISO-X pebble fuel, designed for multi-unit plants ranging from 320-960 MW. The company benefits from Amazon's 5 GW deployment commitment and $985M+ in total funding.

Last Energy offers 20 MWe pressurized water microreactors with modular "LEGO kit" assembly, targeting industrial customers with aggressive 24-month deployment timelines. The company has secured agreements for 80 units, with 39 designated for data centers.

TerraPower operates the most advanced program with its 345 MWe Natrium reactor featuring integrated molten salt energy storage, capable of boosting output to 500 MWe. Construction began in Wyoming with $3.4B total funding including $2B DOE support.

Financial Position Analysis

Capital Efficiency Varies Dramatically: TerraPower demonstrates superior capital efficiency at $4.1M per MW, followed by Last Energy ($3.2M/MW), X-energy ($12.3M/MW), and Radiant Technology ($225M/MW). This reflects fundamental differences in scale and market positioning.

Funding Runway Assessment: X-energy maintains the strongest financial position with 9.9 years of estimated runway, while Last Energy faces the most constrained timeline at 4.3 years.

LCOE Competitiveness: TerraPower projects the lowest LCOE range ($65-95/MWh), followed by X-energy ($70-110/MWh), making them most competitive with conventional generation sources.

Risk Assessment & Investment Recommendations

X-energy: STRONG BUY (30-40% allocation)

Investment Thesis: Best-in-class funding, strategic partnerships, and technology maturity. Amazon's 5 GW commitment provides credible demand validation, while DOE ARDP participation reduces technology risk.

Key Strengths: $985M+ funding, proven TRISO technology, multi-unit scalability, and strong regulatory engagement.

Primary Risks: Extended timeline to commercialization (early 2030s) and dependence on HALEU supply chain development.

TerraPower: BUY (25-35% allocation)

Investment Thesis: Market-leading position with $3.4B funding and active construction in Wyoming. Unique energy storage integration addresses grid flexibility needs.

Key Strengths: Bill Gates backing, NVIDIA investment, most advanced development stage, and grid-scale market opportunity.

Primary Risks: High technology complexity with sodium cooling systems and significant capital requirements.

Radiant Technology: MODERATE BUY (5-10% allocation)

Investment Thesis: Fastest commercialization timeline (2028) targeting stable military demand[1][2]. Mass production model offers scalability potential.

Key Strengths: Strong VC backing (a16z, DCVC), HALEU fuel allocation, and clear market demand from defense applications.

Primary Risks: Very limited scale (1 MW) and high capital intensity constraining broader market applicability.

Last Energy: HOLD/WATCH (0-5% allocation)

Investment Thesis: Attractive unit economics and aggressive deployment timeline, but significant execution risks. Regulatory challenges with NRC create uncertainty.

Key Strengths: Lowest capital per MW, modular approach, and 80 units under agreement.

Primary Risks: Limited funding ($64M total), regulatory disputes, and unproven commercial execution.

Market Context & Strategic Considerations

SMR Market Dynamics

The global SMR market is projected to grow from $6.1 billion in 2023 to $7.7 billion by 2030, representing a 3.3% CAGR[35]. However, industry analysis suggests significant challenges remain, with LCOE estimates ranging from $36-117/MWh depending on deployment scenarios.

Regulatory Timeline Realities

NRC licensing processes typically require 3-4 years for construction permits, with total deployment timelines of 5-10 years from contract to operation. Only NuScale has achieved full NRC design certification to date, highlighting regulatory complexity.

Technology Maturation Requirements

First-of-a-kind (FOAK) projects face substantial cost premiums and schedule risks compared to nth-of-a-kind (NOAK) deployments. Learning effects and economies of scale become critical for long-term competitiveness.

SMR Nuclear Fuel Analysis: Regulatory, Economic, and Disposal Considerations

TRISO Fuel (Radiant Technology & X-energy)

TRISO (Tri-structural Isotropic) fuel features spherical uranium kernels surrounded by protective layers of carbon and silicon carbide, providing exceptional safety characteristics up to 1600°C. Regulatory approval has advanced significantly, with the NRC issuing final safety evaluations for TRISO fuel qualification methodologies in 2025, establishing a common regulatory framework with Canada. X-energy’s TRISO-X facility application was accepted by the NRC with a 30-month review schedule. Procurement costs are substantial at approximately $30,000 per kilogram compared to $2,000/kg for standard fuel, with projections of $15,000/kg at scale. The high cost reflects complex particle fabrication ($25,000/kg) and HALEU enrichment requirements ($5,000/kg vs $1,500/kg for standard uranium). Disposal presents unique challenges due to the graphite matrix, potentially increasing disposal volumes by 37-100% compared to conventional fuel, though the robust containment layers provide superior fission product retention.

HALEU Fuel (TerraPower)

High-Assay Low-Enriched Uranium (HALEU) enriched between 5-20% U-235 enables smaller reactor designs and longer operating cycles. Regulatory frameworks are developing through the DOE’s HALEU Availability Program, with multiple contractors (BWXT, Centrus, Framatome, GE Vernova, Orano, Westinghouse) awarded 10-year contracts worth up to $800 million total. Current commercial production exists only in Russia and the US, creating supply vulnerabilities. Procurement costs for 19.75% enriched HALEU are estimated at $23,725-25,725 per kilogram, with 65% of costs attributed to existing LEU fuel cycle activities and 35% to new HALEU-specific processes. Disposal economics are complicated by higher decay heat generation requiring extended cooling periods (potentially centuries), larger waste packages, or expanded repository footprints, while higher fissile content necessitates enhanced neutron absorbers for long-term criticality control.

Standard Nuclear Fuel (Last Energy)

Standard nuclear fuel using conventional low-enriched uranium (3-5% U-235) in pressurized water reactor configurations represents the most mature technology. Regulatory approval follows well-established NRC frameworks with decades of operational experience, though Last Energy faces specific challenges with their modular approach and deployment timeline disputes. Procurement costs are the most competitive at approximately $2,000 per kilogram including uranium ($842), conversion ($120), enrichment ($401), and fabrication ($300), translating to fuel costs of 0.46¢/kWh. Disposal infrastructure is well-developed with established cost structures of approximately 0.1¢/kWh through the Nuclear Waste Fund, representing the lowest-risk waste management pathway.

Key Investment Implications

Cost Structure Impact: The fuel cost differential is substantial, with TRISO fuels adding $15-25/MWh compared to standard fuel, potentially affecting overall project economics. Last Energy’s standard fuel provides the most predictable cost structure, while advanced fuels require premium market positioning to justify higher operational costs. Supply Chain Risk Assessment: HALEU faces the highest supply vulnerability with only Russian and US production capabilities, creating geopolitical risk for TerraPower. TRISO fuels have limited suppliers but benefit from domestic production capabilities, while standard LEU enjoys mature global supply chains. Regulatory Timeline Considerations: Standard fuel offers the fastest deployment pathway with established frameworks, while TRISO benefits from recent NRC methodology approvals providing clearer regulatory certainty. HALEU relies on ongoing DOE programs with multiple qualified contractors reducing single-point-of-failure risks. Total Lifecycle Cost Impact: When combining fuel, disposal, and supply chain risks, the economic hierarchy shows standard fuel ($5-7/MWh), HALEU ($10-20/MWh), and TRISO ($20-30/MWh), with disposal costs adding 0.1-0.6¢/kWh depending on fuel type. These differentials significantly impact the overall LCOE competitiveness of each SMR technology against conventional generation sources.

Economic Impact Summary

Fuel cost comparison per MWh reveals significant differences: standard fuel costs $5-7/MWh, HALEU approximately $10-20/MWh, and TRISO fuel $20-30/MWh when accounting for enrichment and fabrication complexities. Waste disposal costs range from 0.1¢/kWh for standard fuel to potentially 0.4-0.6¢/kWh for advanced fuels due to volume increases and enhanced containment requirements. Regulatory pathways are most established for standard fuel, moderately developed for HALEU through government programs, and emerging for TRISO with recent NRC approvals providing clearer frameworks. The total lifecycle cost impact suggests advanced fuels could add $15-25/MWh to generation costs compared to standard fuel, requiring offset through improved capacity factors, longer operating cycles, or premium market positioning to maintain economic competitiveness.

Investment Committee Recommendations (to America 2030 not to External Investors)

Portfolio Construction Strategy

Core Holdings (65-75%): Concentrate investments in X-energy and TerraPower as primary positions, leveraging their superior funding, partnerships, and technology maturity.

Satellite Positions (10-15%): Maintain smaller allocation to Radiant Technology for military/niche market exposure and timeline diversification.

Watch List: Monitor Last Energy for potential entry after regulatory resolution and additional funding rounds.

Key Monitoring Metrics

Technical Milestones: Testing schedules, NRC approvals, and construction progress

Commercial Traction: Customer commitments, partnership announcements, and deployment contracts

Financial Health: Funding rounds, burn rates, and capital efficiency improvements

Regulatory Progress: Licensing approvals, permit submissions, and policy developments

Risk Mitigation Approach

Diversification across different technologies (HTGR, PWR, sodium-cooled), market segments (military, industrial, grid-scale), and deployment timelines (2026-2032) provides portfolio resilience against sector-specific risks while maintaining upside exposure to SMR market development.

The SMR sector represents a compelling long-term opportunity driven by decarbonization imperatives and AI-driven energy demand growth, but requires careful selection given significant technology, regulatory, and execution risks across individual companies.

June 2025 Update

Tech Giants’ Nuclear Investment Surge

The U.S. market has witnessed unprecedented nuclear deals from tech giants driven by AI infrastructure demands. Amazon leads with the most comprehensive nuclear strategy, having signed three major agreements in October 2024: a $500 million investment in X-Energy to develop next-generation SMRs, partnerships with Energy Northwest for four SMRs in Washington state, and collaboration with Dominion Energy for Virginia projects. Amazon also secured a massive 1.9 gigawatt power purchase agreement through 2042 from Talen Energy’s Pennsylvania nuclear plant announced in June 2025.

Google pioneered corporate SMR agreements with Kairos Power in October 2024, targeting 500MW of advanced nuclear reactors by 2030, with additional capacity through 2035. Meta joined the nuclear rush in June 2025 with a 20-year deal for 1.1 gigawatts from Constellation Energy’s Illinois reactor, becoming effective in 2027. Microsoft secured nuclear capacity through a 20-year agreement to restart Three Mile Island’s Unit 1, scheduled for 2028.

The small modular reactor (SMR) sector presents compelling investment opportunities for private market investors, with three notable companies—Last Energy, Radiant, and Newcleo—each offering distinct value propositions and risk profiles. This comparative analysis examines their financial positioning, technology approaches, and market strategies from an investor perspective.

Nuclear Energy Stocks

Last Energy positions itself as a commercially-focused microreactor developer with a pragmatic approach to market entry. The company's PWR-20 reactor design targets a sub-$100 million per unit cost, making it accessible to private capital markets. Their full-service delivery model includes power purchase agreements (PPAs), allowing customers to purchase energy without massive upfront capital investments while providing investors with long-term revenue streams. The company has raised $64 million in total funding, with a recent $40 million Series B round completed in August 2024.

Radiant Industries represents a well-capitalized player focused on factory-constructed microreactors. The company secured a substantial $100 million Series C funding round in November 2024, bringing total venture funding to $160 million. Radiant has advanced through the US Department of Energy's microreactor experiment design process and plans to deliver its Kaleidos Development Unit prototype to Idaho National Laboratory's DOME facility for testing in 2026. This regulatory progress and government partnership provide significant validation for private investors.

Newcleo emerges as the European leader in SMR development, having raised €135 million and relocated its headquarters to Paris to improve access to European funding. The company has secured a €20 million grant from Bpifrance and is targeting a €1 billion funding round to accelerate European projects. Newcleo's strategy focuses on building a complete ecosystem from waste management to energy production, with plans to commercialize its first reactors by 2033.

Financial Comparison and Investment Metrics

America 2030 Portfolio Context

Last Energy, Radiant, and Newcleo represent core holdings within America 2030’s strategic investment portfolio, reflecting the firm’s focused thesis on emerging technologies driving America’s industrial and technological renewal. As part of America 2030’s deal pipeline in the nuclear energy sector, these three companies exemplify the investment strategy of targeting cutting-edge ventures developing advanced modular reactors and next-generation designs that leapfrog traditional nuclear technology. This portfolio positioning aligns with America 2030’s broader investment focus on defense and AI infrastructure, recognizing that nuclear energy’s resurgence is fundamentally driven by AI-powered growth and the urgent need for clean, scalable power solutions to bridge the energy gap created by energy-intensive data centers. The firm’s early investments in these SMR pioneers demonstrate strategic foresight in capitalizing on government-backed initiatives and the critical push for energy resilience in an AI-driven economy.

Technology and Market Positioning

Last Energy offers the most commercially viable near-term proposition with its 20 MWe PWR-20 reactor designed for 24-month delivery timelines. The company's focus on standardized, factory-built modules and PPA-based revenue models addresses key investor concerns about capital efficiency and revenue predictability. Their approach targets industrial customers seeking reliable 24/7 clean energy solutions.

Radiant demonstrates strong technical validation through its successful passive cooldown demonstration and DOE partnership. The company's factory-constructed approach and government backing provide credibility, though specific commercial deployment timelines remain less defined than competitors. The involvement of prominent venture capital firms like DCVC and a16z signals confidence in the technology's commercial potential.

Newcleo presents the most comprehensive European strategy, with significant institutional support and a clear regulatory pathway in France. The company's integrated approach to waste management and energy production could provide competitive advantages, though the 2033 commercialization timeline represents a longer investment horizon. The potential €1 billion funding round indicates ambitious scaling plans but also suggests higher capital requirements.

Investment Risk Assessment

Regulatory and Commercial Risks: All three companies face regulatory approval challenges, though Radiant's DOE partnership and Newcleo's French government support provide some mitigation. Last Energy's focus on smaller, standardized units may face fewer regulatory hurdles.

Technology and Execution Risks: Last Energy's simpler PWR technology and shorter deployment timeline present lower technical risk. Radiant's prototype testing in 2026 provides a clear validation milestone. Newcleo's integrated ecosystem approach increases complexity but potentially offers higher returns if successful.

Market and Competitive Risks: The SMR market is projected to grow from $6.9 billion in 2025 to $13.8 billion by 2032, providing substantial opportunity. However, competition is intensifying with multiple players pursuing similar markets.

Investment Recommendations

For Risk-Averse Investors: Last Energy offers the most balanced risk-return profile with its proven PWR technology, clear commercial model, and reasonable capital requirements. The sub-$100 million unit cost and PPA revenue model provide predictable returns with manageable risk exposure.

For Growth-Oriented Investors: Radiant presents high growth potential with strong technical validation and substantial venture backing. The $160 million in funding and government partnerships position the company well for scaling, though commercial deployment timelines remain uncertain.

For Strategic European Investors: Newcleo offers unique European market access with strong institutional support and comprehensive ecosystem approach. The longer timeline to commercialization requires patient capital but could yield significant returns in the European energy transition.

The SMR sector's growth trajectory, driven by energy security needs and decarbonization goals, supports investment in all three companies. However, portfolio diversification across different technologies, geographies, and development stages may provide optimal risk-adjusted returns in this emerging market.

Other companies in SMR technology

Beyond Last Energy, Radiant, and Newcleo, several other private companies have demonstrated significant traction and should be considered in the SMR investment landscape, particularly given the massive funding rounds and tech giant partnerships emerging in 2025.

Major Private Players with Recent Momentum

X-Energy stands out as the most compelling addition to any SMR investment consideration. The company just closed a massive $700 million Series C-1 financing round in February 2025, one of the largest SMR funding rounds to date. Founded by Kam Ghaffarian (who also founded Axiom Space and Intuitive Machines), X-Energy has secured Amazon as a major strategic partner with plans to bring more than 5 GW of new power projects online by 2039. Their Xe-100 reactor design generates 80MW per unit and can scale to 960MW in multi-unit configurations.

Kairos Power has emerged as Google's chosen SMR partner, securing a 500MW power purchase agreement for six to seven SMRs targeting the mid-2030s. The company recently completed installation of its Engineering Test Unit 2.0 reactor vessel and has received $303 million from the U.S. Department of Energy through the Advanced Reactor Demonstration Program[4]. Kairos's Fluoride Salt-Cooled High-Temperature Reactor technology represents a next-generation approach with higher efficiency potential.

TerraPower, Bill Gates' nuclear venture founded in 2006, raised at least $750 million in 2022 with a major $250 million investment from South Korean conglomerate SK Group. The company is developing its first test plant at a shuttered coal site in Wyoming, scheduled for service in 2028. TerraPower's factory-manufactured approach and high-profile backing position it as a significant player.

Publicly Traded Companies Worth Monitoring

Oklo has gone public and achieved remarkable market performance with a 248% gain over the past six months and current market capitalization of $8.88 billion. The company's unique business model involves building, owning, and operating reactor fleets while selling power directly under long-term contracts, potentially offering more attractive economics than traditional reactor sales models.

NuScale Power remains the only SMR developer with U.S. Nuclear Regulatory Commission design approval and has secured a $1.35 billion Department of Energy grant[8]. Despite facing challenges with its Idaho project, the company's regulatory milestone provides significant validation for the SMR sector.

Strategic Considerations for Investors

The SMR market is experiencing unprecedented momentum driven by tech giants' massive energy demands for AI and data center operations. Amazon, Google, and Microsoft are all actively investing in or partnering with SMR developers, creating a new category of creditworthy, long-term customers that didn't exist in previous nuclear cycles.

Market dynamics favor companies with:

Tech giant partnerships providing both funding and guaranteed demand

Advanced regulatory progress reducing development risk

Scalable manufacturing approaches enabling cost reduction

Diverse technology approaches (PWR, molten salt, gas-cooled) spreading technical risk

The global SMR market, valued at approximately $9.88 billion in 2023, is projected to grow at a 3.6% CAGR through 2032. However, recent funding activity suggests this growth may accelerate significantly as energy security and AI infrastructure demands intensify.

BWX Technologies also deserves mention as a critical infrastructure provider, having secured over C$1 billion in nuclear project contracts including SMR components for Ontario's Darlington site. While not purely an SMR developer, BWXT's manufacturing capabilities make it essential to the sector's scaling.

For private market investors, X-Energy and Kairos Power represent the most attractive near-term opportunities given their substantial funding, tech partnerships, and regulatory progress. TerraPower offers exposure to proven leadership and Korean market access, while the public markets provide liquidity through Oklo and NuScale for those seeking immediate exposure to SMR sector growth.

Which company had more traction in the past 24 months?

Based on recent developments over the past 24 months, Last Energy has demonstrated the most significant commercial and regulatory traction among the three companies.

Last Energy's Breakthrough Progress

Last Energy has achieved several critical regulatory milestones that position it ahead of competitors. In February 2025, the company became the first SMR project in the UK to enter the nuclear site licensing process with the Office for Nuclear Regulation, marking the first new commercial nuclear site to enter licensing since 1978. This regulatory acceptance represents a major validation of their technology and business model.

The company has also secured substantial financial backing and commercial validation. In December 2024, Last Energy received a $103.7 million letter of intent from the US Export-Import Bank for debt financing of their South Wales project. This follows their $40 million Series B funding round completed in August 2024, bringing total capital raised to $64 million. Most importantly, they've demonstrated strong commercial demand with agreements for 80+ reactor units worth over $32 billion across Europe.

Last Energy's accelerated deployment timeline sets them apart, with the first Welsh plant potentially operational by 2027. They've successfully demonstrated fabrication and transport capabilities with prototype showcases in Poland, Houston, and Washington D.C. throughout 2023-2024.

Radiant's Technical Validation

Radiant has made impressive funding and technical progress but with longer commercialization timelines. The company secured a massive $100 million Series C round in November 2024, bringing total venture funding to $160 million[5]. They successfully completed their passive cooldown demonstration and advanced through the DOE's microreactor experiment design process.

However, Radiant's commercial deployment remains further out, with their Kaleidos Development Unit prototype scheduled for testing at Idaho National Laboratory's DOME facility in 2026. While they report production commitments for more than 10 reactors through 2030, this represents significantly less commercial traction than Last Energy's 80+ unit agreements.

Newcleo's European Expansion

Newcleo has shown strong institutional support but faces the longest path to commercialization. The company raised €135 million in 2024 and relocated headquarters from London to Paris to access European funding. They've secured regulatory acceptance for their LFR-AS-200 reactor design in the UK's Generic Design Assessment process in June 2025.

However, Newcleo's commercial timeline extends to 2033 for first revenue-generating reactors, significantly longer than competitors. While they've established over 90 partnerships and employ more than 1,000 people across 19 locations, their revenue in 2024 was only €70 million compared to massive commercial agreements secured by Last Energy.

Comparative Traction Analysis

Regulatory Progress: Last Energy leads with actual site licensing approval, while others remain in earlier assessment phases.

Commercial Validation: Last Energy's $32 billion in commercial agreements far exceeds competitors' disclosed commitments.

Financial Efficiency: Despite raising less capital ($64 million vs. Radiant's $160 million and Newcleo's €535 million), Last Energy has achieved more concrete commercial milestones.

Timeline to Revenue: Last Energy's 2027 target deployment significantly outpaces Radiant's 2028+ timeline and Newcleo's 2033 commercialization.

Last Energy's combination of regulatory approval, substantial commercial agreements, export financing commitment, and near-term deployment timeline demonstrates the strongest overall traction in transforming from development-stage company to commercial nuclear operator.

Comparing for Funding, Revenue and Launch KPIs

Based on the latest available data, here's a comprehensive comparison of the key SMR companies' funding, revenue, and commercial launch timelines:

Funding Leaders: TerraPower leads with nearly $1 billion raised, followed by X-Energy's recent $700 million round. These massive funding rounds reflect the capital-intensive nature of nuclear technology development and the growing confidence from investors and tech giants.

Revenue Generation: TerraPower shows the highest current revenue at $369.1 million, followed by X-Energy at $179.5 million. Most companies are still in pre-commercial phases, with revenue primarily from development contracts and partnerships rather than reactor sales.

Commercial Timeline: Last Energy targets the earliest commercial deployment with its 2026-2027 Wales project timeline. TerraPower follows closely with its 2030 Wyoming plant, while most others target the 2030s.

Market Validation: The substantial funding rounds in 2025, particularly X-Energy's $700 million and Radiant's $225 million, demonstrate unprecedented investor confidence in SMR commercialization. Tech giant partnerships with Amazon (X-Energy) and Google (Kairos Power) provide both funding and guaranteed demand, fundamentally changing the SMR investment landscape.

Regulatory Progress: Last Energy's entry into UK nuclear site licensing in February 2025 represents a significant regulatory milestone, making it the first new commercial nuclear site to enter licensing since 1978. This regulatory validation supports their aggressive 2026-2027 deployment timeline.

Regulatory and Licensing Framework Analysis

Last Energy demonstrates the strongest regulatory momentum with concrete approvals across multiple jurisdictions. The company became the first SMR project in the UK to enter nuclear site licensing in February 2025, marking a historic milestone as the first new commercial nuclear site to enter licensing since 1978. Additionally, Last Energy has completed the pre-authorization phase with Romania’s National Commission for Nuclear Activities Control, providing dual-pathway regulatory validation. Their engagement with the DOE’s in-kind voucher program and partnership with Oak Ridge National Laboratory further strengthens their regulatory positioning. Radiant has established a solid regulatory foundation through its pre-application process with the U.S. Nuclear Regulatory Commission, initiated in October 2022. The company participated in public NRC meetings and submitted a comprehensive Regulatory Engagement Plan. Critically, Radiant was selected as one of only five U.S. companies to receive high-assay low-enriched uranium (HALEU) fuel from the Department of Energy, demonstrating significant regulatory confidence in their technology approach. Newcleo has achieved notable regulatory progress in both France and the UK. The company completed the preparatory stage with French nuclear regulator Autorité de Sûreté Nucléaire (ASN) in August 2024, involving extensive technical meetings with about twenty specialized experts. This preparatory phase facilitates accelerated review of future license applications. Newcleo has also secured regulatory acceptance for their LFR-AS-200 reactor design in the UK’s Generic Design Assessment process.

Technology Differentiation and Manufacturing Strategy

Last Energy leverages proven pressurized water reactor (PWR) technology in their PWR-20 design, minimizing technical risk while focusing on manufacturing innovation. Their 20 MWe reactors are designed as modular units that “snap together like a LEGO kit”, enabling 24-month fabrication and assembly timelines. The company has demonstrated prototype capabilities with showcases in Poland, Houston, and Washington D.C., validating their factory-production approach. Radiant employs high-temperature gas-cooled reactor technology with helium cooling and TRISO fuel, representing more advanced but unproven technology compared to traditional PWR designs. Their Kaleidos 1 MWe microreactor targets mobile applications for remote and military installations. The company is building manufacturing capabilities to produce up to 50 microreactors annually, though this represents significantly lower scale than competitors. Newcleo pursues the most technically ambitious approach with lead-cooled fast reactors (LFR) using molten lead coolant and spent plutonium/uranium waste as fuel. This technology promises waste reduction benefits but introduces substantial technical complexity. The company is investing €133 million in a Turin R&D center through 2027, indicating significant ongoing technology development requirements.

Market Positioning and Customer Validation

Last Energy has secured the strongest commercial validation with agreements for 80+ reactor units worth over $32 billion, including 39 units specifically for data center applications. Their full-service delivery model, where Last Energy owns and operates plants on customer sites, addresses key market barriers around capital requirements and operational expertise. The $103.7 million letter of intent from the US Export-Import Bank for their South Wales project provides additional commercial credibility. Radiant reports production commitments for more than 10 reactors through 2030, significantly less than Last Energy’s commercial pipeline. However, their focus on military and remote applications may provide more defensible market positioning, given the specialized requirements and limited competition in these segments. Newcleo has established over 90 partnerships globally and employs more than 1,000 people across 19 locations, demonstrating broad ecosystem development. However, their 2033 commercialization timeline places them furthest from revenue generation. The company’s integrated approach to waste management and energy production could provide competitive advantages in European markets with significant nuclear waste challenges.

Financial Efficiency and Capital Requirements

Last Energy demonstrates superior capital efficiency, having achieved substantial commercial agreements and regulatory milestones with only $64 million in total funding. Their sub-$100 million per unit cost target and PPA-based revenue model provide attractive unit economics and predictable cash flows. Radiant has raised $225 million in total funding, significantly more than Last Energy, while achieving fewer concrete commercial milestones. However, their recent $165 million Series C round led by prominent investors like DCVC and Andreessen Horowitz indicates strong investor confidence in their technology approach. Newcleo requires the highest capital intensity, having raised €535 million to date and targeting a €1 billion funding round to accelerate European projects. While this reflects the company’s ambitious integrated ecosystem approach, it also indicates substantially higher capital requirements compared to competitors.

Risk Assessment and Mitigation

Technology Risk: Last Energy presents the lowest technology risk with proven PWR technology, while Newcleo’s lead-cooled fast reactor represents the highest technical risk but potentially highest returns if successful. Regulatory Risk: All three companies have demonstrated regulatory engagement, though Last Energy’s actual licensing approvals provide the strongest risk mitigation. Market Risk: Last Energy’s data center focus aligns with rapidly growing AI infrastructure demands, while Radiant’s military applications provide recession-resistant demand. Newcleo’s European focus benefits from strong institutional support but faces longer commercialization timelines. Execution Risk: Last Energy’s 2026-2027 deployment timeline presents the nearest execution test, while Newcleo’s 2033 timeline allows more development time but increases market and technology evolution risks.

Investment Recommendation Matrix

For growth-oriented investors seeking near-term returns, Last Energy offers the most compelling risk-adjusted opportunity with proven technology, regulatory approvals, substantial commercial agreements, and efficient capital utilization. For technology-focused investors willing to accept higher risk for potentially transformative returns, Newcleo’s waste-recycling approach and comprehensive European ecosystem could yield significant long-term value. For defense and specialty market investors, Radiant’s military applications and technical validation through DOE partnerships provide exposure to specialized, high-value market segments. The SMR sector’s unprecedented momentum, driven by AI infrastructure demands and energy security concerns, supports investment across multiple approaches. However, Last Energy’s combination of regulatory progress, commercial validation, and capital efficiency positions it as the sector leader for private market investors seeking balanced risk-return profiles in nuclear technology commercialization.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.