Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

October Update on Live Investments, Covering the Previous 90 Days

October Update on Live Investments, Covering the Previous 90 Days

Addepar's Latest Funding Round

Addepar, the wealth management tech provider, is raising $250 million at a $3.25 billion pre-money valuation, marking a 50% increase since 2021. With $6 trillion in assets managed and 1,200+ institutional clients, Addepar’s growth is fueled by product innovations like Addepar Trading and AI initiatives. The company aims for cash-flow positivity by 2025, positioning itself as a leader in the competitive fintech landscape.

Addepar update, Q3 2024

Addepar expands its wealth management solutions with the launch of a native trading platform and a strategic partnership with Itaú Private Bank, enhancing global investment capabilities.

#Addepar #TradingPlatform #ItaúPrivateBank #WealthManagement #InvestmentTechnology #DataAggregation #PortfolioRebalancing #FinancialServices #StrategicPartnership #GlobalInvestments

Think Outside the Boxes: Rethinking the VC Playbook for AI Investment

Most VC firms invest in the same well-trodden paths of the AI value chain, from applications to hardware. But IPO CLUB sees opportunity in the overlooked fundamentals — electricity, data, communication infrastructure, and more. Learn why thinking outside the boxes drives better returns.

Trump’s Policies Impact on selected US growth companies

Donald's Honeymoon.

With Donald Trump’s election as President of the United States, there is significant anticipation about how his proposed policies—spanning #deregulation, #tax#reforms, and international #trade—might reshape certain industries and the #leading#growth#startups in #America.

We have divided selected portfolio companies into three groups: Strongly Positive, Positive and Somewhat Positive.

US tech wins the elections

Donald Trump’s recent re-election promises a favorable climate for U.S. late-stage tech startups, with policies on deregulation, tax incentives, reshoring, and emerging technologies driving potential growth. Enhanced government partnerships, particularly in AI and aerospace, are expected to bolster opportunities for venture-backed companies poised for expansion.

AI and the Railway Mania: Lessons from History’s Investment Bubbles

The AI investment frenzy, exemplified by OpenAI's recent $157 billion valuation, mirrors past bubbles like the 19th-century railway boom. Investors are drawn in by revolutionary potential, but history teaches us that overestimating demand, speculative behavior, and lack of regulation can lead to failure. To succeed, investors must focus on fundamentals and long-term viability.

Mario Draghi’s report And Unlocking Europe’s Venture Capital Potential

Europe’s venture capital market faces critical challenges, from fragmented markets to underdeveloped capital ecosystems. With only 5% of global VC funding, European startups often relocate to the U.S. for better access to capital. IPO Club’s experience reflects these dynamics, highlighting the need for market reforms to retain innovation, talent, and funding within Europe.

#VentureCapital #EuropeanStartups #TechInnovation #CapitalMarkets #InvestmentStrategy #ScalingInnovation #MarioDraghi #StartupEcosystem #PrivateEquity #USInvestments #GlobalEconomy #Entrepreneurship #FinancialMarkets

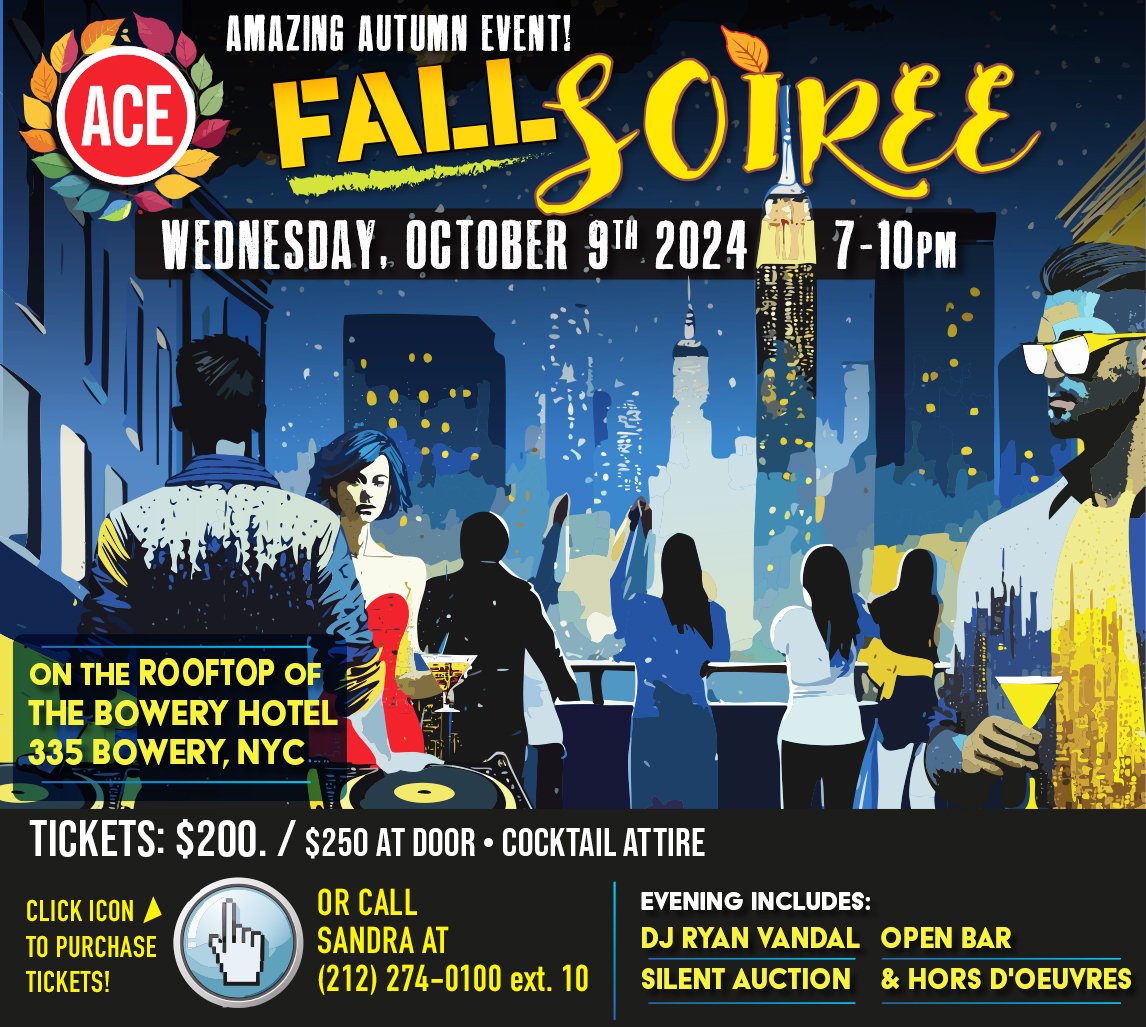

ACE fall event in NEW YORK

Join ACE’s Fall Soirée on October 9, 2024, for a chic night on The Bowery Hotel Rooftop in NYC, featuring live music, an open bar, hors d’oeuvres, and a silent auction.

#ACEFallSoirée #NYCEvents #TheBoweryHotel #Fall2024 #RooftopParty #NYCNightlife #OpenBar #DJRyanVandal #CocktailAttire

Powering the AI Revolution

As AI continues to revolutionize industries, the energy demands of training and deploying large-scale models are surging. Understanding the cost-effectiveness and sustainability of different power sources is crucial for AI data centers to manage operational costs and environmental impact.

#AI #EnergyConsumption #DataCenters #RenewableEnergy #NuclearPower #SolarEnergy #WindEnergy #Sustainability #CarbonNeutral #TechIndustry #ArtificialIntelligence