Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

October Update on Live Investments, Covering the Previous 90 Days

October Update on Live Investments, Covering the Previous 90 Days

Boxabl 2024 Form 10-K Summary: A Crossroads Between Innovation and Execution

In 2024, Boxabl invested over $40 million to generate $3.4 million in revenue, selling 51 Casitas and making operational and regulatory advancements across several states. Key operational milestones include the certification of 83 installers, regulatory approvals in New Mexico, Nevada, and California, and continued R&D to expand the product line both up-market and down-market.

Boxabl Investor Update: California and Nevada Approvals

Boxabl, the innovative housing technology startup, has recently announced significant milestones that could potentially impact its future growth and revenue. This report aims to update investors on these developments and their potential implications.

BOXABL Unveils Casita Model at UNLV, Showcasing Innovative Affordable Housing Solutions

BOXABL showcases its innovative Casita model at UNLV, offering sustainable and affordable housing solutions. The 361-square-foot unit, powered by off-grid solar, is open for public viewing starting October 17. BOXABL aims to revolutionize housing with versatile, scalable designs suitable for various applications.

#BOXABL #Casita #UNLV #AffordableHousing #SustainableLiving #FactoryBuiltHousing #SolarEnergy #StudentHousing #HousingInnovation #ScalableSolutions #EnergyEfficiency #LasVegas #HousingRevolution

Think Outside the Boxes: Rethinking the VC Playbook for AI Investment

Most VC firms invest in the same well-trodden paths of the AI value chain, from applications to hardware. But IPO CLUB sees opportunity in the overlooked fundamentals — electricity, data, communication infrastructure, and more. Learn why thinking outside the boxes drives better returns.

Trump’s Policies Impact on selected US growth companies

Donald's Honeymoon.

With Donald Trump’s election as President of the United States, there is significant anticipation about how his proposed policies—spanning #deregulation, #tax#reforms, and international #trade—might reshape certain industries and the #leading#growth#startups in #America.

We have divided selected portfolio companies into three groups: Strongly Positive, Positive and Somewhat Positive.

US tech wins the elections

Donald Trump’s recent re-election promises a favorable climate for U.S. late-stage tech startups, with policies on deregulation, tax incentives, reshoring, and emerging technologies driving potential growth. Enhanced government partnerships, particularly in AI and aerospace, are expected to bolster opportunities for venture-backed companies poised for expansion.

Mario Draghi’s report And Unlocking Europe’s Venture Capital Potential

Europe’s venture capital market faces critical challenges, from fragmented markets to underdeveloped capital ecosystems. With only 5% of global VC funding, European startups often relocate to the U.S. for better access to capital. IPO Club’s experience reflects these dynamics, highlighting the need for market reforms to retain innovation, talent, and funding within Europe.

#VentureCapital #EuropeanStartups #TechInnovation #CapitalMarkets #InvestmentStrategy #ScalingInnovation #MarioDraghi #StartupEcosystem #PrivateEquity #USInvestments #GlobalEconomy #Entrepreneurship #FinancialMarkets

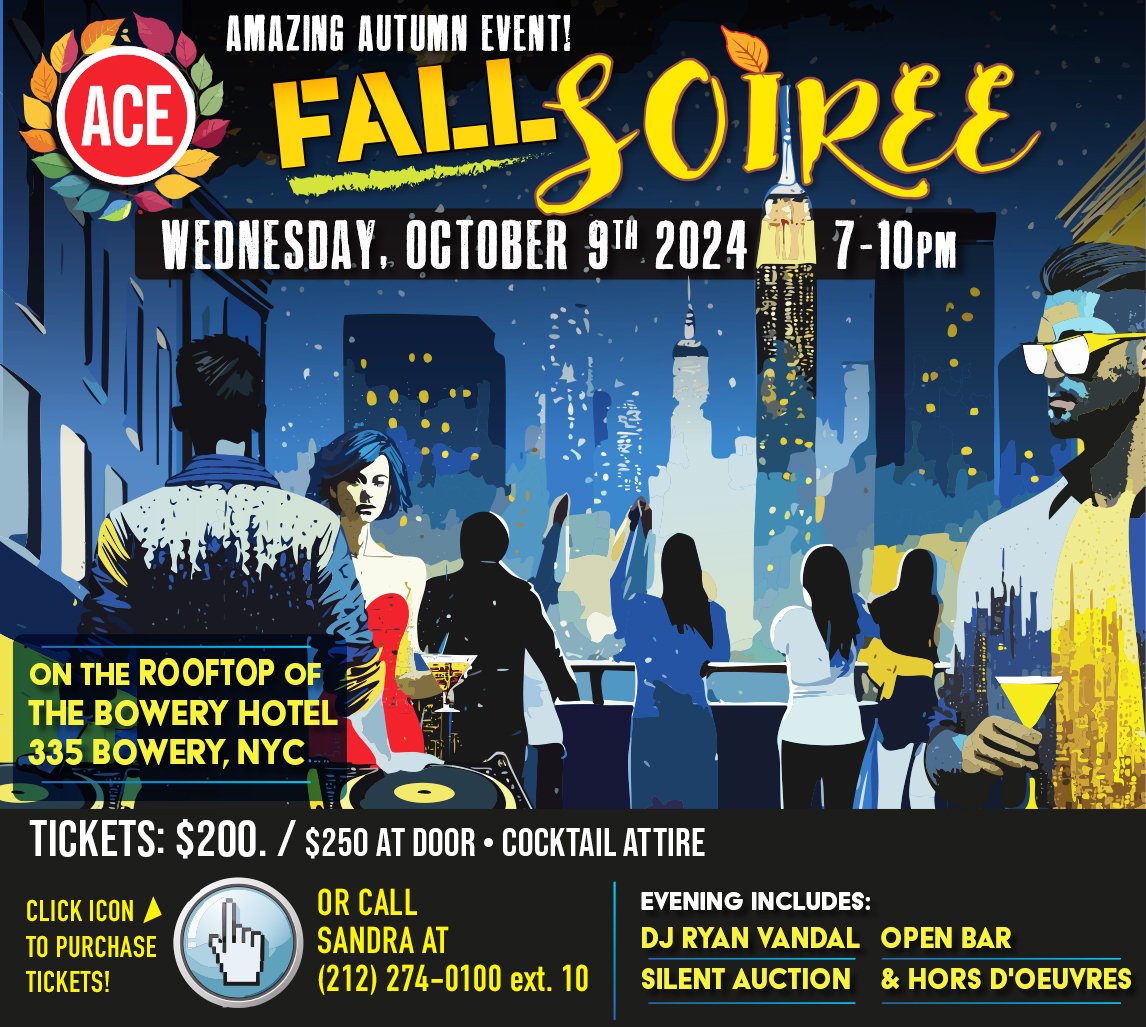

ACE fall event in NEW YORK

Join ACE’s Fall Soirée on October 9, 2024, for a chic night on The Bowery Hotel Rooftop in NYC, featuring live music, an open bar, hors d’oeuvres, and a silent auction.

#ACEFallSoirée #NYCEvents #TheBoweryHotel #Fall2024 #RooftopParty #NYCNightlife #OpenBar #DJRyanVandal #CocktailAttire

Investing in Robotics

Robotics startups have struggled commercially despite significant innovation. Challenges include high R&D costs, technical difficulties, and market saturation. While success stories like Kiva Systems exist, failures have been more common due to difficult economics, margin compression, and integration challenges.

#robotics #startups #innovation #KivaSystems #R&D #margins #commercialization #technology #automation #techindustry #investing #venturecapital #marketchallenges