Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

October Update on Live Investments, Covering the Previous 90 Days

October Update on Live Investments, Covering the Previous 90 Days

Neuralink begins testing brain-controlled assistive robotics

Neuralink has launched its CONVOY study, testing its brain-computer interface (BCI) for controlling assistive robotic devices. The study’s first participant, Alex, who is paralyzed from the neck down, previously used Neuralink’s BCI to design graphics telepathically. Now, he will explore controlling a robotic arm, marking a major step in assistive tech.

Neuralink stock update, December 2024

Neuralink’s brain-computer interface progresses with a second human trial and enhanced device stability. The implant shows potential to revolutionize human-computer interactions, allowing paralyzed individuals to control devices through thought alone. However, ethical considerations and device safety remain central to its experimental development.

#Neuralink #BrainComputerInterface #BCI #ElonMusk #HumanTrials #Neurotechnology #MedicalInnovation #ParalysisTreatment #CADSoftware #EthicsInTech #TechAdvancements #BCIResearch #BrainImplants

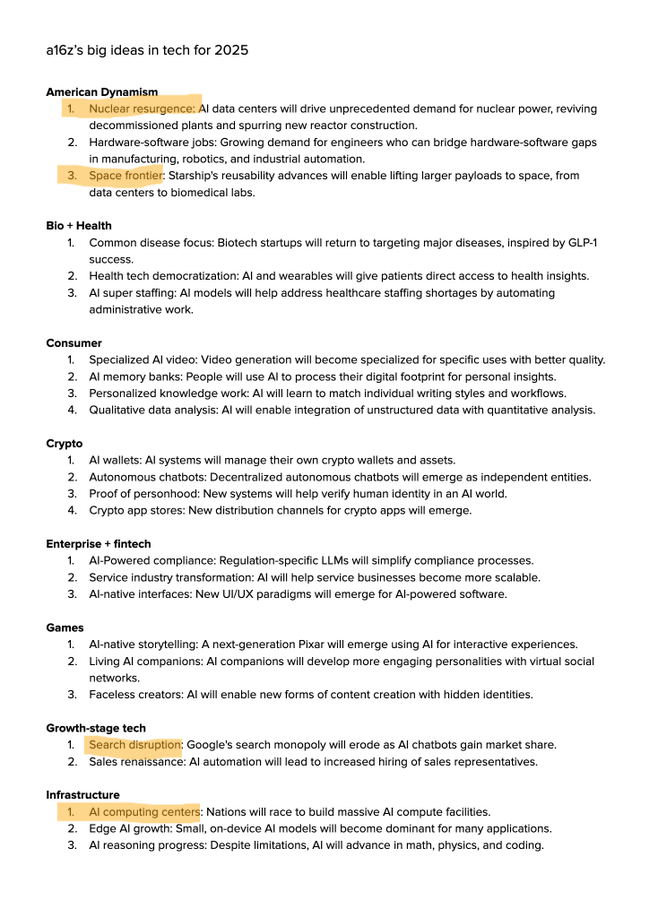

Trend Is Your Friend: Tech’s Biggest Ideas for 2025

AMERICA2030’s portfolio reflects a commitment to shaping the future through investments in critical technologies. From nuclear energy and reusable rockets to AI-disrupting search and custom computing hardware, we provide unparalleled exposure to the technologies driving America’s industrial renewal.

Think Outside the Boxes: Rethinking the VC Playbook for AI Investment

Most VC firms invest in the same well-trodden paths of the AI value chain, from applications to hardware. But IPO CLUB sees opportunity in the overlooked fundamentals — electricity, data, communication infrastructure, and more. Learn why thinking outside the boxes drives better returns.

Trump’s Policies Impact on selected US growth companies

Donald's Honeymoon.

With Donald Trump’s election as President of the United States, there is significant anticipation about how his proposed policies—spanning #deregulation, #tax#reforms, and international #trade—might reshape certain industries and the #leading#growth#startups in #America.

We have divided selected portfolio companies into three groups: Strongly Positive, Positive and Somewhat Positive.

US tech wins the elections

Donald Trump’s recent re-election promises a favorable climate for U.S. late-stage tech startups, with policies on deregulation, tax incentives, reshoring, and emerging technologies driving potential growth. Enhanced government partnerships, particularly in AI and aerospace, are expected to bolster opportunities for venture-backed companies poised for expansion.

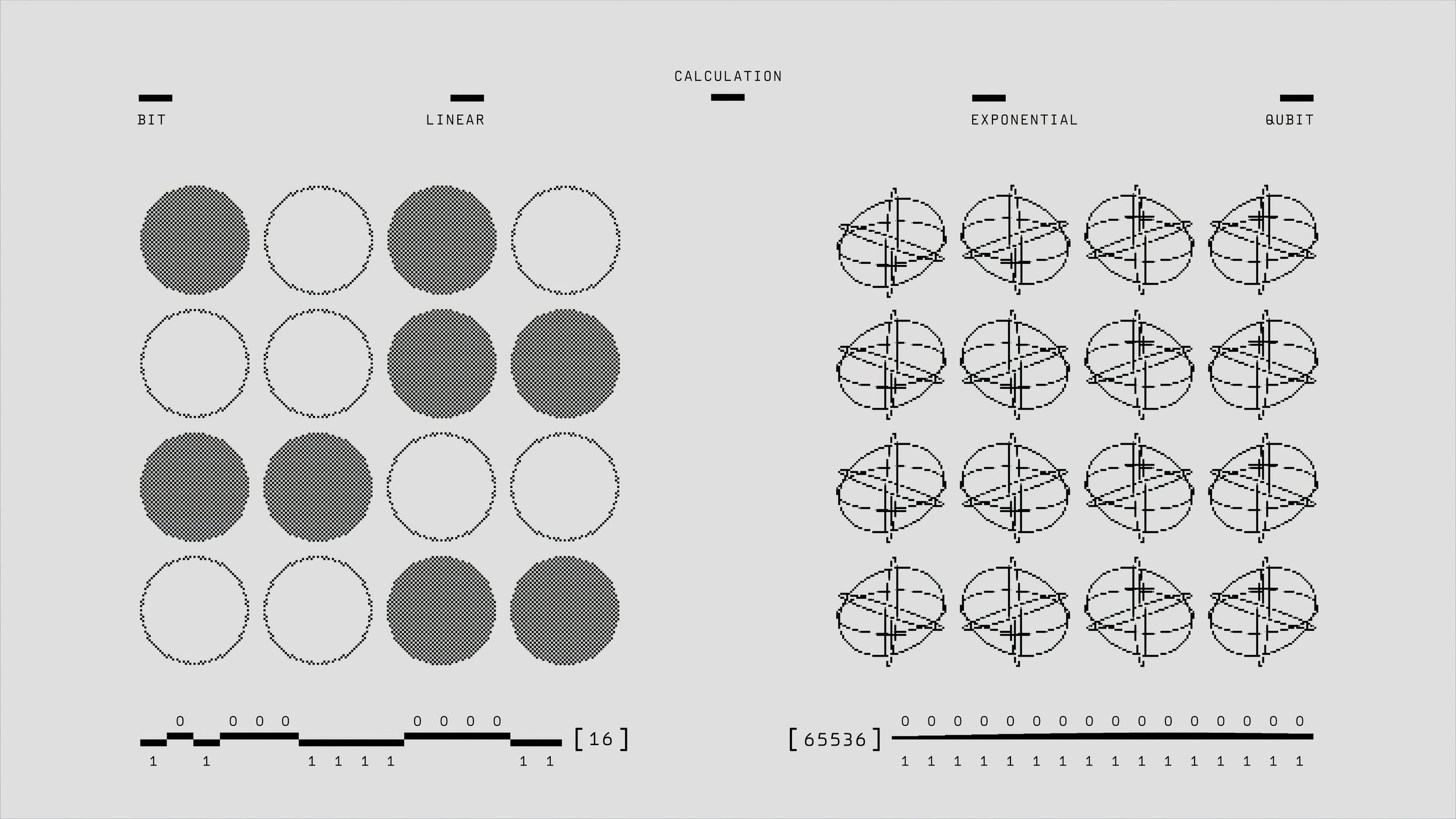

Is Quantum Computing Underfunded in the U.S.?

Quantum computing in the U.S. faces funding challenges relative to its potential, particularly in defense. With venture funding of only $1.2 billion in 2023 and public funding lagging behind other nations, quantum could benefit from increased strategic investment. Quantum’s impact on cryptography, secure communications, and defense logistics highlights the need for greater support in this critical sector.

AI and the Railway Mania: Lessons from History’s Investment Bubbles

The AI investment frenzy, exemplified by OpenAI's recent $157 billion valuation, mirrors past bubbles like the 19th-century railway boom. Investors are drawn in by revolutionary potential, but history teaches us that overestimating demand, speculative behavior, and lack of regulation can lead to failure. To succeed, investors must focus on fundamentals and long-term viability.

Neuralink stock update

Neuralink, Elon Musk’s brain-chip startup, secured FDA “breakthrough device” status for its Blindsight implant, aimed at restoring vision even in those without optic nerves. Backed by over $500M in funding, Neuralink faces competition from companies like Synchron and Paradromics. With strengths in innovation and potential market impact, challenges include regulatory delays and ethical concerns.