Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

October Update on Live Investments, Covering the Previous 90 Days

October Update on Live Investments, Covering the Previous 90 Days

AI Meteoric Rise in Frontier Technologies

The global AI market is set to surge from $189 billion in 2023 to $4.8 trillion by 2033, driving growth equity investment and reshaping frontier technologies. AI’s market share will jump from 7% to 29%, outpacing IoT, blockchain, and electric vehicles. Discover key trends and growth equity opportunities in AI’s trillion-dollar future.

OpenAI's ChatGPT Pro Subscription Losses

The recent revelation by Sam Altman, CEO of OpenAI, that the company is currently losing money on its $200 per month ChatGPT Pro subscriptions is a stark reminder of the financial tightrope that innovation in AI often requires. This admission was made in a candid social media post where Altman described the situation as an "insane thing," highlighting how the usage of the Pro plan has exceeded expectations, leading to unexpectedly high operational costs.

Trend Is Your Friend: Tech’s Biggest Ideas for 2025

AMERICA2030’s portfolio reflects a commitment to shaping the future through investments in critical technologies. From nuclear energy and reusable rockets to AI-disrupting search and custom computing hardware, we provide unparalleled exposure to the technologies driving America’s industrial renewal.

OpenAI and Palantir Join Forces with Anduril to Revolutionize Defense AI

Silicon Valley giants OpenAI and Palantir partner with defense-tech leader Anduril to advance AI in military applications. Focus areas include counter-drone systems and secure data structuring for national security.

#OpenAI #Palantir #Anduril #DefenseAI #CounterDroneSystems #CUAS #GenerativeAI #AIinDefense #NationalSecurity #Anthropic #xAI #SamAltman #TechPartnerships #ArtificialIntelligence #DefenseInnovation #GenerativeAIMarket

Think Outside the Boxes: Rethinking the VC Playbook for AI Investment

Most VC firms invest in the same well-trodden paths of the AI value chain, from applications to hardware. But IPO CLUB sees opportunity in the overlooked fundamentals — electricity, data, communication infrastructure, and more. Learn why thinking outside the boxes drives better returns.

US tech wins the elections

Donald Trump’s recent re-election promises a favorable climate for U.S. late-stage tech startups, with policies on deregulation, tax incentives, reshoring, and emerging technologies driving potential growth. Enhanced government partnerships, particularly in AI and aerospace, are expected to bolster opportunities for venture-backed companies poised for expansion.

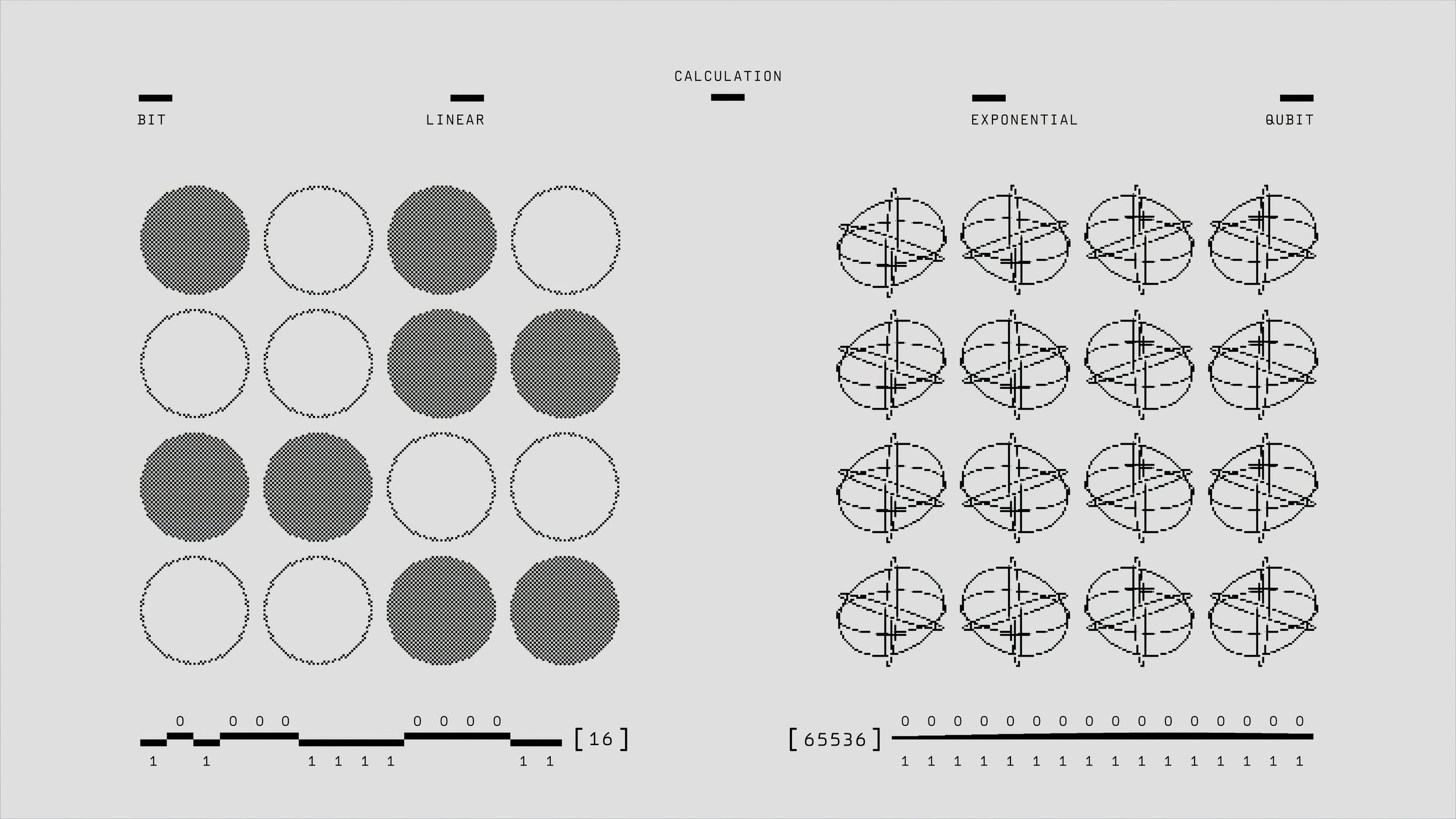

Is Quantum Computing Underfunded in the U.S.?

Quantum computing in the U.S. faces funding challenges relative to its potential, particularly in defense. With venture funding of only $1.2 billion in 2023 and public funding lagging behind other nations, quantum could benefit from increased strategic investment. Quantum’s impact on cryptography, secure communications, and defense logistics highlights the need for greater support in this critical sector.

AI and the Railway Mania: Lessons from History’s Investment Bubbles

The AI investment frenzy, exemplified by OpenAI's recent $157 billion valuation, mirrors past bubbles like the 19th-century railway boom. Investors are drawn in by revolutionary potential, but history teaches us that overestimating demand, speculative behavior, and lack of regulation can lead to failure. To succeed, investors must focus on fundamentals and long-term viability.

OpenAI's Latest Funding Round Set to Exceed $150 Billion Valuation

OpenAI's upcoming funding round is not just a financial milestone; it signals the critical role AI will play in the future of technology. With Nvidia, Apple, and Microsoft aligning themselves with OpenAI, the company is poised to continue pushing the boundaries of artificial intelligence, even as regulatory scrutiny increases. Investors and tech firms alike recognize AI's transformative potential, marking OpenAI as a key player in this rapidly evolving landscape.