LATEST NEWS ON PRE IPO COMPANIES

Follow the news on the most interesting pre ipo companies.

Mario Draghi’s report And Unlocking Europe’s Venture Capital Potential

Europe’s venture capital market faces critical challenges, from fragmented markets to underdeveloped capital ecosystems. With only 5% of global VC funding, European startups often relocate to the U.S. for better access to capital. IPO Club’s experience reflects these dynamics, highlighting the need for market reforms to retain innovation, talent, and funding within Europe.

#VentureCapital #EuropeanStartups #TechInnovation #CapitalMarkets #InvestmentStrategy #ScalingInnovation #MarioDraghi #StartupEcosystem #PrivateEquity #USInvestments #GlobalEconomy #Entrepreneurship #FinancialMarkets

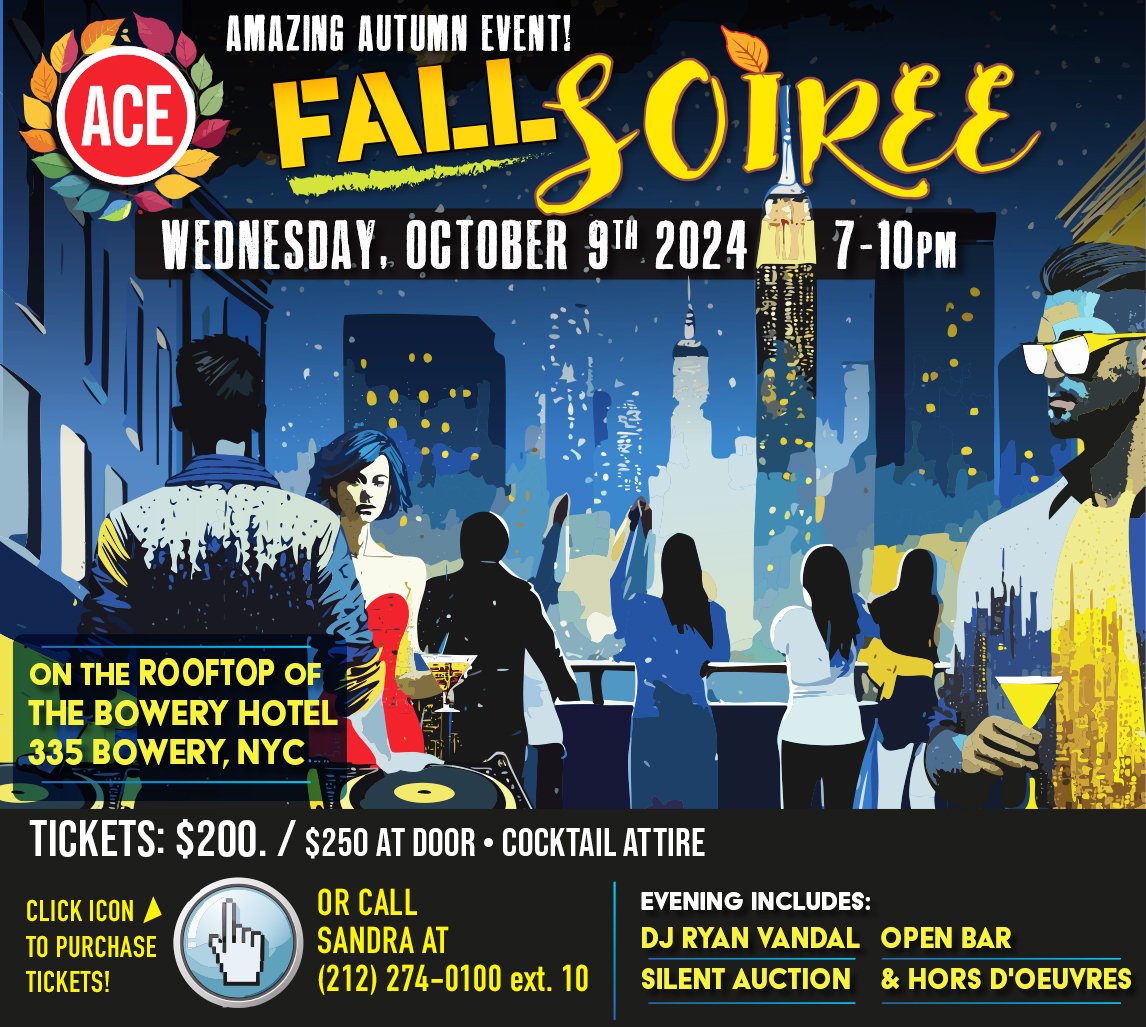

ACE fall event in NEW YORK

Join ACE’s Fall Soirée on October 9, 2024, for a chic night on The Bowery Hotel Rooftop in NYC, featuring live music, an open bar, hors d’oeuvres, and a silent auction.

#ACEFallSoirée #NYCEvents #TheBoweryHotel #Fall2024 #RooftopParty #NYCNightlife #OpenBar #DJRyanVandal #CocktailAttire

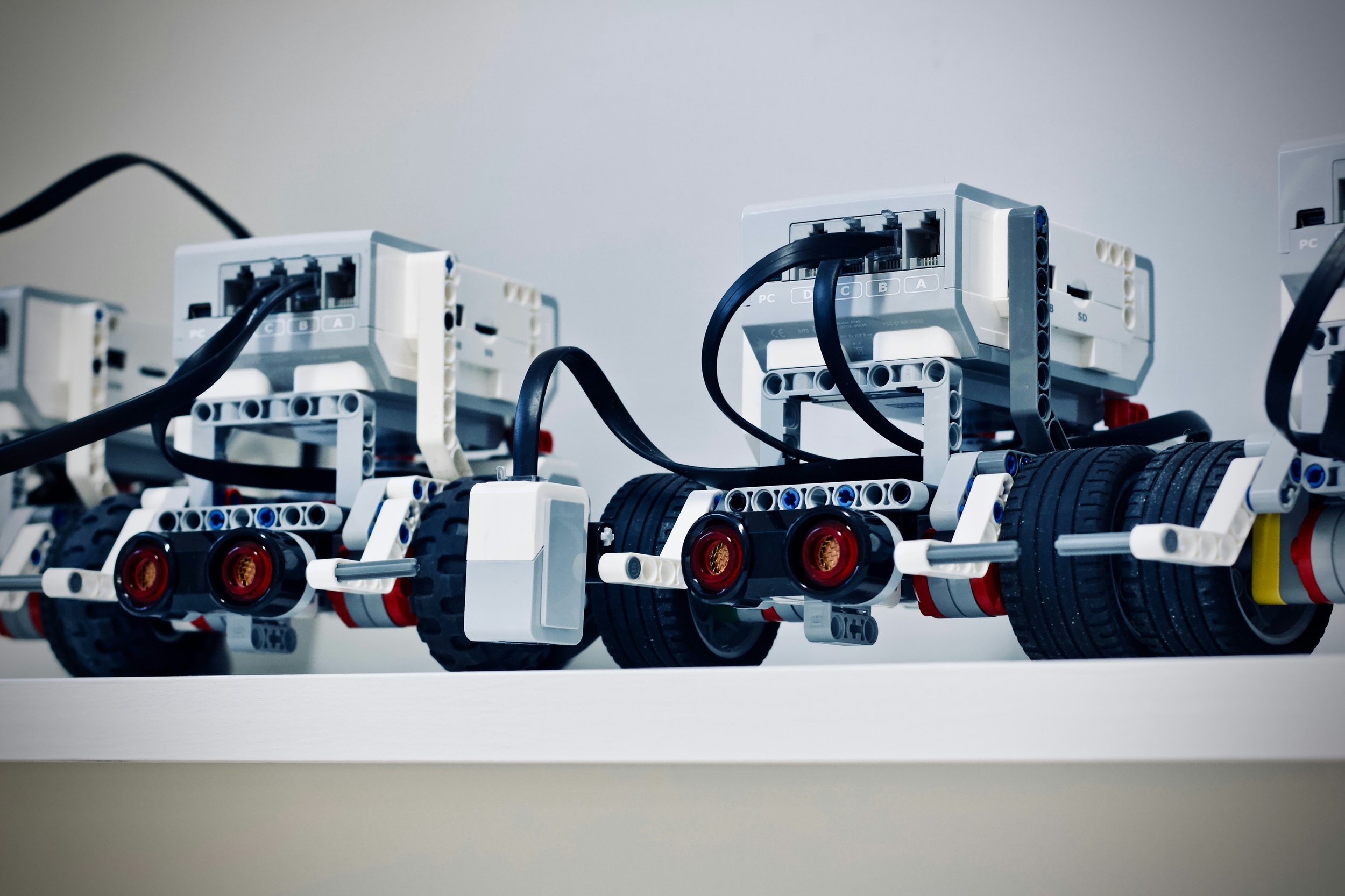

Investing in Robotics

Robotics startups have struggled commercially despite significant innovation. Challenges include high R&D costs, technical difficulties, and market saturation. While success stories like Kiva Systems exist, failures have been more common due to difficult economics, margin compression, and integration challenges.

#robotics #startups #innovation #KivaSystems #R&D #margins #commercialization #technology #automation #techindustry #investing #venturecapital #marketchallenges

VC Investment in AI

The influx of capital into AI reflects broader venture trends, demanding returns that stretch plausibility. With $125B invested annually, VCs must achieve 3x returns. Expect volatility in secondaries as supply increases and discounts become more pronounced.

#VentureCapital #AICapital #SecondaryMarkets #LimitedPartners #MarketVolatility #InvestmentReturns #VC #NetAssetValue #InvestmentStrategy

Venture Capital Thematic Investing: Risks and Pitfalls

Focusing too much on trendy investment themes in venture capital can lead to inefficiencies and suboptimal returns. The best investments often lie outside predefined theses, offering less competition and higher potential.

Venture capital, Canva, startup funding, innovation, Melanie Perkins, AirBnB, WhatsApp, SpaceX, Dropbox, investment challenges, design software, entrepreneurial success.

Pre-IPO stocks Q2 update

In Q2 2024, venture capital activity remains robust with heightened liquidity and stabilized trade volumes around $10M, despite a slight dip from Q1 peak levels. Significant transactions over $50M are resurfacing, indicating strong investor confidence.

#VentureCapital #Q22024 #MarketAnalysis #InvestorBehavior #TradeVolumes #Liquidity #ActiveBuyers #Investment #FinancialMarket

Northvolt: Pioneering Europe's Battery Revolution and Eyeing IPO

Northvolt, a Swedish battery manufacturer founded by former Tesla executives, is rapidly expanding in Europe and North America. With over $9 billion raised and significant partnerships with major automakers, Northvolt is poised for a major IPO within the next two years. Explore the company's history, growth, and future prospects in this detailed analysis.

#Northvolt #IPO #LithiumIonBatteries #RenewableEnergy #ElectricVehicles #SustainableInvesting #GreenTech #BatteryManufacturing #Europe #TeslaExecutives #Stockholm #Skellefteå #Investment #VentureCapital #BlackRock #Volkswagen #BMW #Volvo #Polestar

Private Markets Q2 Report (so far)

Upcoming IPOs to watch in 2024 include Databricks, Cerebras, Circle, Klarna, Skims, Monzo, and Fanatics. These companies are set to impact the tech and fintech sectors significantly.

#IPO #PreIPO #Databricks #Cerebras #Circle #Klarna #Skims #Monzo #Fanatics #TechIPO #Fintech #Investment #StockMarket

Why We Love Venture Capital

Venture capital offers unmatched excitement and opportunities by investing in early-stage companies. Understanding psychology, corporate culture, and macroeconomic trends is crucial for navigating this dynamic field.

Keywords: #VentureCapital #InvestmentStrategy #CorporateCulture #Macroeconomics #InterestRates #Inflation #ContrarianInvesting #Agility #LongTermVision

Is Carbon a Good Investment?

Carbon offset prices are projected to rise significantly by 2030 due to regulatory changes and increased demand, with California and EU markets leading the trend. Voluntary market prices show wide potential variation, reflecting market dynamics.

Keywords

#CarbonOffsets #CaliforniaCarbonPrices #EUAllowances #VoluntaryCarbonMarket #CarbonMarketTrends #Sustainability #NetZeroTargets #EnvironmentalRegulations #CarbonCredits #BloombergNEF #ClimateTrade

What exactly is climate fintech?

Climate fintech merges technology and sustainability, attracting $2.3 billion in 2023 despite broader fintech downturns, highlighting its potential and resilience in supporting eco-friendly initiatives.

Keywords:

#ClimateFintech #GreenFintech #SustainableInvesting #ESG #CarbonMarkets #EnergyManagement #InvestmentTrends #DigitalTechnologies #EnvironmentalSustainability #VentureCapital

Mastercard's Role in Sustainable Consumption

Ellen Jackowsky, Mastercard’s Chief Sustainability Officer, discusses the role of payment processors in reducing carbon emissions and highlights Mastercard's strategic initiatives and consumer trends driving sustainability in the financial sector.

Keywords: #EllenJackowsky #Mastercard #Sustainability #ClimateChange #InvestmentOpportunities #VentureCapital #PaymentProcessing #EnvironmentalImpact #ConsumerBehavior #TechInnovation

The Voluntary Carbon Market: A Beginner’s Guide.

Explore the multifaceted structure of the voluntary carbon market (VCM), where standards, development, and verification converge to produce carbon credits. Uncover the strategic role of brokers and end buyers in driving carbon offsetting initiatives. Navigate the regulatory landscape shaped by the Paris Agreement as we delve into the pricing intricacies and tackle the challenges confronting the VCM, including double counting and market inefficiencies. This guide is an insightful beacon for stakeholders engaging in climate action through the voluntary carbon offset market.

Keywords for social media:

#VoluntaryCarbonMarket #CarbonCredits #GreenhouseGas #ParisAgreement #CarbonOffsetting #ClimateAction #Sustainability #CarbonTrading #EnvironmentalIntegrity #Decarbonization #MarketChallenges #LocalOffsetting #ClimateRegulations #CarbonFinance

IPO Market pergnant with tech companies.

Discover the vibrant lineup of tech companies ready to debut on the stock market in 2024. From Rubrik and Plaid to Stripe.

Explore how these enterprises are poised to energize the IPO scene despite fluctuating valuations and market conditions.

Keywords: #TechIPOs2024 #DiscordIPO #RedditIPO #ChimeIPO #KlarnaValuation #StripeIPO #CerebrasAI #Stripe #Plaid #Rubrik #VentureBackedCompanies #IPOMarketTrends #StockMarket2024

Stabiliti Enhances Sustainability Efforts through Strategic Partnership with Green Cross UK

Stabiliti teams up with Green Cross UK to bolster global sustainability efforts, leveraging shared visions and innovative carbon removal solutions.

#Stabiliti #GreenCrossUK #Sustainability #CarbonRemoval #StrategicPartnership #ClimateChange #EnvironmentalStewardship #InnovationInSustainability

Dismissed Distributions?

Venture capital’s allure has always been rooted in its promise of outsized returns, derived from the successful incubation and maturation of groundbreaking startups. Yet, there's an emerging narrative that reveals a critical oversight in the venture capital saga: the Dismissed Distributions.

ACE NEW YORK $5,000,000 Capital Campaign supported by IPO CLUB.

IPO CLUB proudly supports the Association of Community Employment Programs for the Homeless (ACE), a distinguished 501(c)(3) nonprofit organization committed to transforming lives in New York City. Since 1992, ACE has provided job training, education, and support services to the homeless, aiding their journey toward economic independence and societal reintegration.