The AI Arms Race: How China tries to Overtake the U.S. by 2030

The Global AI Battle: U.S. vs. China

The race for artificial intelligence (AI) supremacy is no longer a theoretical competition—it’s a geopolitical arms race. The U.S. and China are locked in a high-stakes battle for control over the technology that will define economic, military, and surveillance capabilities in the coming decades.

China has set a clear deadline: surpass the U.S. in AI by 2030. To achieve this, Beijing is deploying a mix of aggressive industrial policies, strategic state investments, and—according to U.S. intelligence officials—intellectual property (IP) theft.

1. China’s AI Strategy: Centralized, State-Backed, and Aggressive

Unlike the U.S., where AI development is largely driven by private companies like OpenAI, Google DeepMind, and Microsoft, China’s approach is state-directed. The Chinese Communist Party (CCP) views AI as a pillar of national power, integrating it into its economic and military strategy.

Key pillars of China’s AI push:

• Massive State Investment: China has committed $150 billion to AI development through its “New Generation AI Development Plan.”

• Surveillance AI: China deploys AI for citizen tracking, social credit scoring, and censorship, providing real-world training data at an unprecedented scale.

• Subsidized AI Companies: Firms like DeepSeek, Huawei, and Baidu receive state funding to develop models that compete with U.S. AI leaders.

• Regulatory Arbitrage: Unlike Western firms, Chinese AI developers are largely immune from copyright and data privacy laws, giving them access to vast amounts of training data.

China’s advantage in AI isn’t just about government support—it’s also about playing by different rules.

2. Allegations of AI Espionage: China’s IP Theft Strategy

Recent reports indicate that China is not just investing in AI—it’s actively stealing AI secrets from American firms. U.S. intelligence agencies and corporate leaders have warned that China is using cyber-espionage, corporate infiltration, and state-backed hacking groups to gain access to cutting-edge AI models.

Evidence of AI Espionage

• Anthropic CEO Warns of AI Theft

• In March 2025, Anthropic CEO Dario Amodei revealed that spies are targeting U.S. AI firms to steal AI breakthroughs in just a few lines of code.

• “Some AI secrets worth $100 million can be reduced to a few lines of code,” Amodei warned.

• Chinese Hackers Target AI Research

• In 2024, Microsoft reported that Chinese hacking group “Volt Typhoon” was infiltrating U.S. infrastructure and AI firms.

• In 2025, several AI firms, including OpenAI and Google DeepMind, reported cyberattacks linked to China.

• U.S. Lawmakers Sound the Alarm

• FBI Director Christopher Wray has repeatedly testified that China’s AI espionage is the “largest intellectual property theft campaign in history.”

• The U.S. Department of Justice has charged multiple individuals with attempting to smuggle AI research to China.

3. DeepSeek: The Face of “Authoritarian AI”

One of the most concerning players in China’s AI expansion is DeepSeek, a state-subsidized AI company that has drawn comparisons to Huawei.

Why is DeepSeek a Threat?

• State-Controlled: DeepSeek is subsidized by the CCP, meaning its AI models align with government interests.

• Privacy Violations: Unlike U.S. AI firms, DeepSeek has no data privacy restrictions, giving it access to unlimited training data.

• Ethical Concerns: Reports suggest DeepSeek’s models are more willing to generate harmful content, including guidance on fraud and intellectual property theft.

Much like Huawei before it, DeepSeek is seen as a tool of the Chinese government, raising concerns about AI security risks. OpenAI has urged the U.S. government to ban DeepSeek, warning that it could be used for cyber warfare, mass surveillance, and global disinformation campaigns.

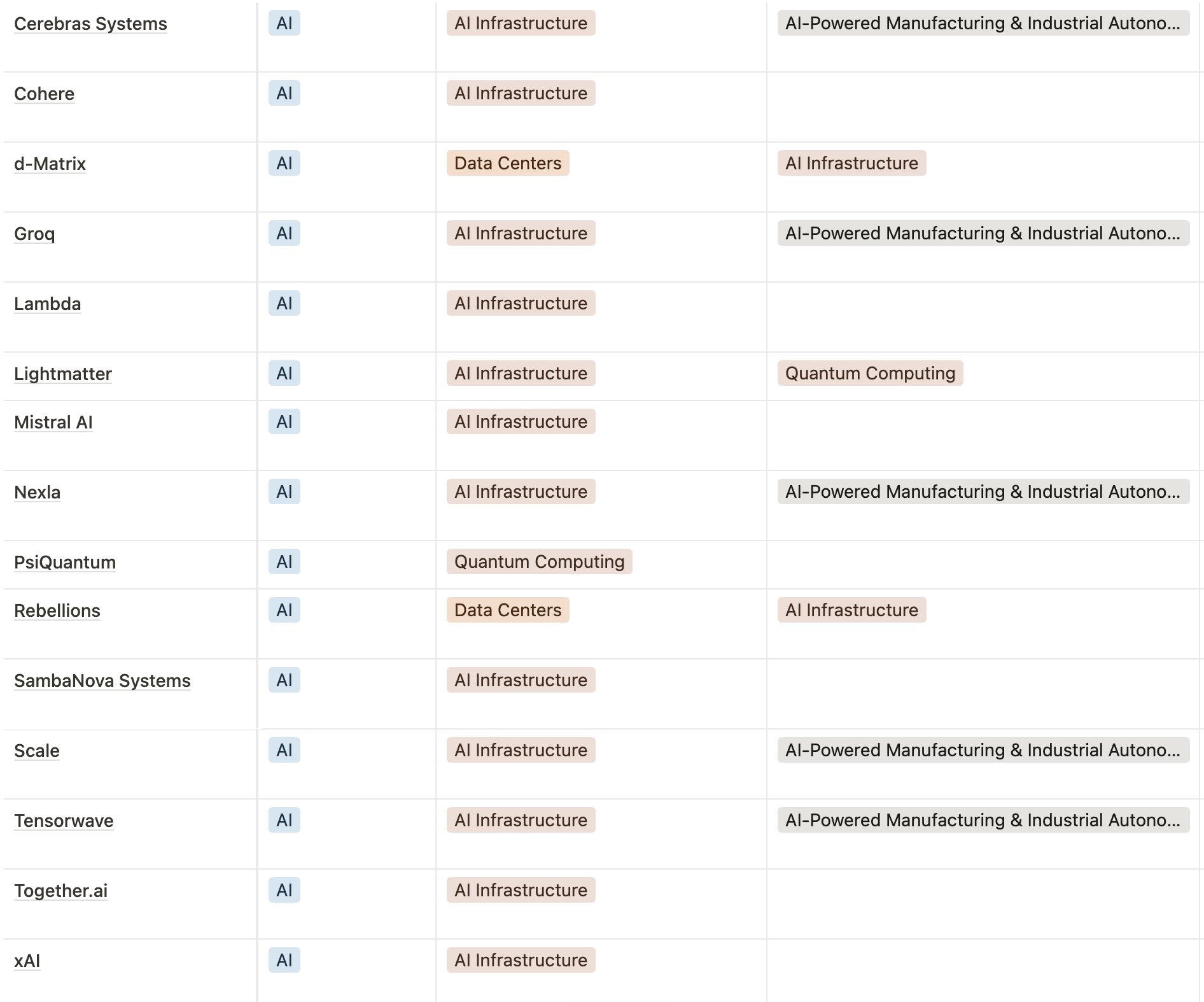

AMERICA 2030 AI pipeline

4. America’s Response: Can the U.S. Maintain AI Supremacy?

To counter China’s AI ambitions, OpenAI and other industry leaders are calling for a multi-pronged approach:

1. Government-Private Sector Partnership

• The U.S. must align AI firms with national security interests, much like the Defense Advanced Research Projects Agency (DARPA) partnership in the 1960s.

2. Export Controls & AI Bans

• The U.S. has already restricted China’s access to advanced AI chips, such as Nvidia’s A100 and H100.

• Now, OpenAI is pushing for a ban on DeepSeek and other Chinese AI firms, much like the Huawei restrictions from 2017 to 2022.

3. AI Copyright & Regulation Reform

• OpenAI argues that excessive AI regulation in the U.S. is slowing down innovation, while China benefits from looser laws.

• The company is urging policymakers to clarify copyright rules to ensure American AI firms have access to robust training data.

4. Massive AI Infrastructure Investment

• AI is expensive, and China is investing billions in data centers, chips, and computing power.

• OpenAI argues that the U.S. must match or exceed China’s AI infrastructure spending to stay ahead.

5. The Road to 2030: Who Will Win?

The AI race between the U.S. and China is not just about technology—it’s about global power, economic dominance, and national security.

China’s Advantages

✅ State backing & unlimited resources

✅ Massive data collection for AI training

✅ Regulatory freedom & IP theft

U.S. Advantages

✅ Private sector innovation & competition

✅ Top AI talent & cutting-edge research

✅ Stronger international AI partnerships

The question remains: Will America’s free-market AI model outpace China’s centralized, state-backed approach?

By 2030, the world will have an answer.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies. Join us.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.