Multiple on Invested Capital (or “MOIC”) in Venture Capital

Multiple on Invested Capital (MOIC) is a widely utilized financial metric in the realm of venture capital. It's a powerful tool that venture capitalists and other investment professionals often leverage to evaluate the performance of their investments. MOIC, which stands for Multiple On Invested Capital, provides these professionals with a clear understanding of how much value an investment has generated in relation to the capital initially invested.

MOIC, as a term, may seem complex or intimidating for those who are unfamiliar with financial jargon. However, its underlying concept is quite straightforward. Essentially, MOIC measures the return on an investment, not in percentage terms like most traditional financial metrics, but as a multiple. For instance, if you invested $1 million in a venture, and the investment value grew to $2 million, the MOIC would be 2.0x, meaning your investment doubled.

One significant advantage of MOIC is that it is a gross metric, indicating that it is calculated prior to the deduction of fees and carry. The term 'carry' here refers to the share of the profits that the venture capital firm or investment manager takes as compensation for their services. This is often a substantial amount, and being able to analyze performance before the application of these costs can provide a more accurate picture of the raw return on investment.

Moreover, the MOIC can be used to gauge the performance of both realized and unrealized investments. Realized investments are those which the venture capitalist has sold and turned into liquid cash. Unrealized investments, on the other hand, are still held by the venture capitalist and have yet to be sold. This versatility allows MOIC to be a comprehensive performance measurement tool, as it can evaluate a broad range of investment situations.

The applicability of MOIC extends beyond individual deals and can also be used at the portfolio level. This means that venture capitalists can use it to determine the overall performance of a collection of investments. It provides an average performance number for all investments under consideration, giving a broad perspective on the portfolio's success or failure.

MOIC has carved a significant niche for itself in performance reporting due to its ease of use. It reduces complexity and gives a clear, concise number that indicates the return on investment. This user-friendliness makes it an incredibly valuable tool in the fast-paced, high-stakes world of venture capital.

A MOIC of 1.50x, for instance, translates to a 50 percent rise in the value of the initial investment. There's no need to convert percentages or calculate compound interest; the MOIC simply states how many times the initial investment has increased in value.

Comparatively, the MOIC often proves to be more intuitive than the Internal Rate of Return (IRR). While IRR is a useful metric, it can be confusing for some people because it factors in the time value of money. In contrast, MOIC sidesteps this issue by focusing solely on the gross change in value, making it a more straightforward measure of investment performance.

However, the simplicity of MOIC also has its drawbacks. It notably doesn't consider the time factor in its calculation. For example, an investment that doubles in value over ten years has a different real performance compared to an investment that doubles in value within just two years.

Despite this limitation, MOIC remains a popular choice among venture capitalists. The benefits of its simplicity and straightforwardness, especially when compared to more complex metrics like IRR, have solidified its position in the toolkit of venture capitalists and investment professionals.

To visualize how MOIC works, consider the following example: suppose a venture capital firm invests $10 million in a promising start-up. After a few years, the value of this investment rises to $20 million. The MOIC in this case would be 2.0x, indicating that the value of the initial investment has doubled.

In conclusion, MOIC is a significant performance metric in venture capital. Its ease of use, broad applicability, and ability to measure performance before fees make it a valuable tool for venture capitalists. Though it may have limitations, particularly in failing to account for the time factor, it offers a clear and concise measure of investment performance, aiding in decision-making and providing insights into the health and potential of investments.

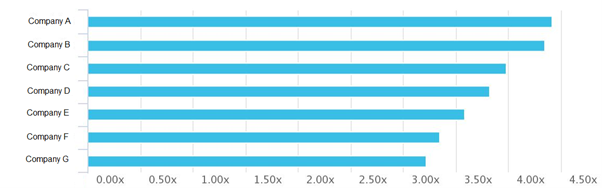

See an illustration below:

How is MOIC calculated?

Multiple on Invested Capital (MOIC) is calculated by dividing the current or exit value of an investment by the initial amount of capital invested. For example, if a venture capitalist invests $2 million in a start-up and later sells their stake for $6 million, the MOIC would be 3.0x ($6 million / $2 million). This calculation suggests that the investment has tripled in value. It's crucial to remember that MOIC is a gross metric calculated before the deduction of fees or carried interest thus it shows the raw return on investment.

The difference with IRR

The Internal Rate of Return (IRR) and the Multiple on Invested Capital (MOIC) are both measures of investment performance but focus on different aspects. While MOIC quantifies the multiple returns on the initial investment, it does not take the duration of the investment into account. On the other hand, IRR does consider the time value of money. The IRR is the rate at which the net present value of the investment's costs (cash flows invested) equals the net present value of the benefits (cash returns). Therefore, IRR provides a more comprehensive picture of the investment's profitability, as it accounts for both the magnitude and timing of expected cash flows. This difference makes IRR more complex to calculate than MOIC but potentially more informative, especially for long-term investments.

#markets #privateequity #VentureCapital #vc #PreIPO #IPO #investing #familyoffice #wealthmanagement #venture #savings #savingforretirement #compounding #MOIC