LATEST NEWS ON PRE IPO COMPANIES

follow the news on the most interesting pre ipo companies.

Venture Capital Thematic Investing: Risks and Pitfalls

Focusing too much on trendy investment themes in venture capital can lead to inefficiencies and suboptimal returns. The best investments often lie outside predefined theses, offering less competition and higher potential.

Venture capital, Canva, startup funding, innovation, Melanie Perkins, AirBnB, WhatsApp, SpaceX, Dropbox, investment challenges, design software, entrepreneurial success.

Musk: Texas as a Hub

Centralizing xAI, Neuralink, and SpaceX in Texas enhances collaboration and operational efficiency, accelerating Musk's vision for the future. Discover how this strategic move benefits IPO CLUB's portfolio companies.

AI is Transforming Patient Care

AI transforms healthcare by enabling continuous patient support through advanced data synthesis and communication, promising better outcomes and lower costs.

#AIinHealthcare #ArtificialIntelligence #PatientSupport #HealthcareRevolution #MedicalAI #AGI #42ROBOTS #HealthTech #Cybersecurity #DigitalHealth #HealthcareInnovation

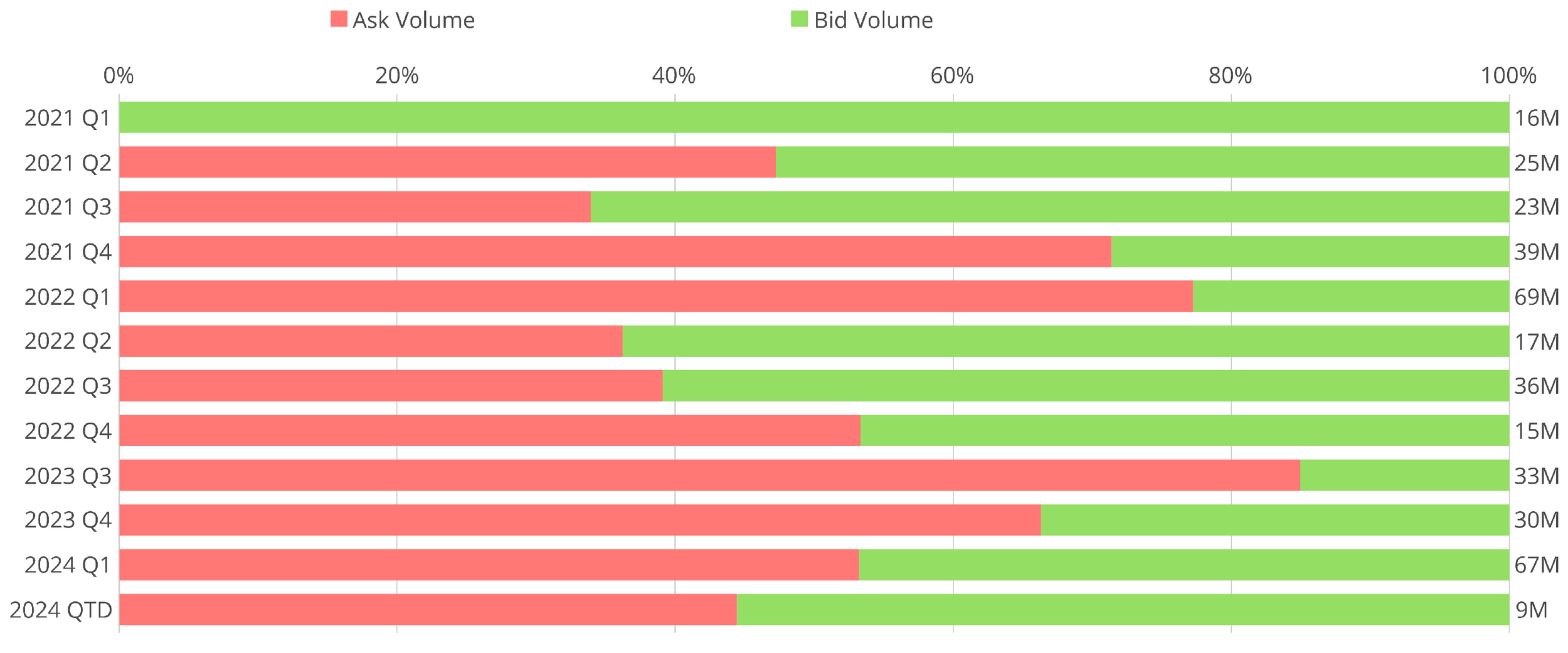

Pre-IPO stocks Q2 update

In Q2 2024, venture capital activity remains robust with heightened liquidity and stabilized trade volumes around $10M, despite a slight dip from Q1 peak levels. Significant transactions over $50M are resurfacing, indicating strong investor confidence.

#VentureCapital #Q22024 #MarketAnalysis #InvestorBehavior #TradeVolumes #Liquidity #ActiveBuyers #Investment #FinancialMarket

Anduril stock in current funding round

Anduril Industries is in the process of securing $12.5B valuation in Series F funding round led by Founders Fund and Sands Capital, emphasizing R&D and global expansion.

#Anduril #DefenseTech #VentureCapital #Funding #TechInvestment #AndurilStock #DefenseTechGrowth #InvestmentTrends #MarketAnalysis

How to become an accredited investor

How to become an accredited investor?

An accredited investor is an individual or institution that has earned special status to invest in unregulated securities such as pre-IPO and venture funds.

To qualify as an accredited investor, you must meet certain qualifications, such as being a high earner or having a net worth of $1 million.

Unregistered securities are inherently risky but often offer higher rates of return, allowing accredited investors to build wealth quickly.

Kraken Eyes Funding Round Ahead of possible IPO

Kraken is eyeing a $100M funding round ahead of a potential IPO amid Bitcoin's surge above $73,000. It plans to launch a public offering next year.

Kraken, IPO, Bitcoin, crypto exchange, funding round, SEC, regulatory challenges, cryptocurrency, digital assets, investment.

#Kraken #IPO #Bitcoin #CryptoExchange #FundingRound #SEC #Cryptocurrency #DigitalAssets #Investment

Northvolt: Pioneering Europe's Battery Revolution and Eyeing IPO

Northvolt, a Swedish battery manufacturer founded by former Tesla executives, is rapidly expanding in Europe and North America. With over $9 billion raised and significant partnerships with major automakers, Northvolt is poised for a major IPO within the next two years. Explore the company's history, growth, and future prospects in this detailed analysis.

#Northvolt #IPO #LithiumIonBatteries #RenewableEnergy #ElectricVehicles #SustainableInvesting #GreenTech #BatteryManufacturing #Europe #TeslaExecutives #Stockholm #Skellefteå #Investment #VentureCapital #BlackRock #Volkswagen #BMW #Volvo #Polestar

Addepar stock update, Q2 2024

Apevue recently reported the bid-offer ratio for Addepar, showing an increasing interest in the name on the bid side and increasing trading volume on the stock.

Growth, depressed valuation, and trading volume will increase Addepar’s stock price before year-end. We should see the stock price return at least to the level of the last primary round in December 2021, which was $2.65 ($2.1B valuation). #Addepar #Fintech #InvestmentManagement #WealthManagement #FinancialAdvisors #PortfolioAnalysis #PrivateBanks #FamilyOffices #DataAggregation #FinancialTechnology #ClientBase #RIA #InvestmentAdvisors

Private Markets Q2 Report (so far)

Upcoming IPOs to watch in 2024 include Databricks, Cerebras, Circle, Klarna, Skims, Monzo, and Fanatics. These companies are set to impact the tech and fintech sectors significantly.

#IPO #PreIPO #Databricks #Cerebras #Circle #Klarna #Skims #Monzo #Fanatics #TechIPO #Fintech #Investment #StockMarket

Kraken offers equity to users

Kraken raises over $6 million daily by offering equity to users via BnkToTheFuture, reflecting bullish cryptocurrency market sentiment and Kraken's expanding global presence.

#Kraken #cryptocurrency #exchange #equityoffering #BnkToTheFuture #Bitcoin #investment #fundraising #CryptoFacilities #cryptomarket #investors #blockchain #regulations

Another Day, Another AI Unicorn

Groq, Inc. is revolutionizing AI with its high-performance LPU technology, offering unprecedented speed and efficiency in GenAI inference. Backed by top investors, Groq is poised for significant growth.

#Groq #AI #LPU #GenAI #LLM #Nvidia #GlobalFoundries #Samsung #SocialCapital #TigerGlobal #SeriesD #Investment #TechInnovation #AIHardware #ComputeDensity #MemoryBandwidth

Why We Love Venture Capital

Venture capital offers unmatched excitement and opportunities by investing in early-stage companies. Understanding psychology, corporate culture, and macroeconomic trends is crucial for navigating this dynamic field.

Keywords: #VentureCapital #InvestmentStrategy #CorporateCulture #Macroeconomics #InterestRates #Inflation #ContrarianInvesting #Agility #LongTermVision

Is Carbon a Good Investment?

Carbon offset prices are projected to rise significantly by 2030 due to regulatory changes and increased demand, with California and EU markets leading the trend. Voluntary market prices show wide potential variation, reflecting market dynamics.

Keywords

#CarbonOffsets #CaliforniaCarbonPrices #EUAllowances #VoluntaryCarbonMarket #CarbonMarketTrends #Sustainability #NetZeroTargets #EnvironmentalRegulations #CarbonCredits #BloombergNEF #ClimateTrade

Google vs. Openai

Google's latest I/O event unveiled impressive tech advancements, yet it seemed a step behind OpenAI's offerings in terms of performance and vision. The introduction of Google's Trillion TPU highlights a competitive edge in hardware, yet it lacks responsiveness and innovation compared to OpenAI’s solutions.

#GoogleIO2024 #OpenAI #AItechnology #AIhardware #TPUTrillion #AIinnovation #SiliconValley #technews

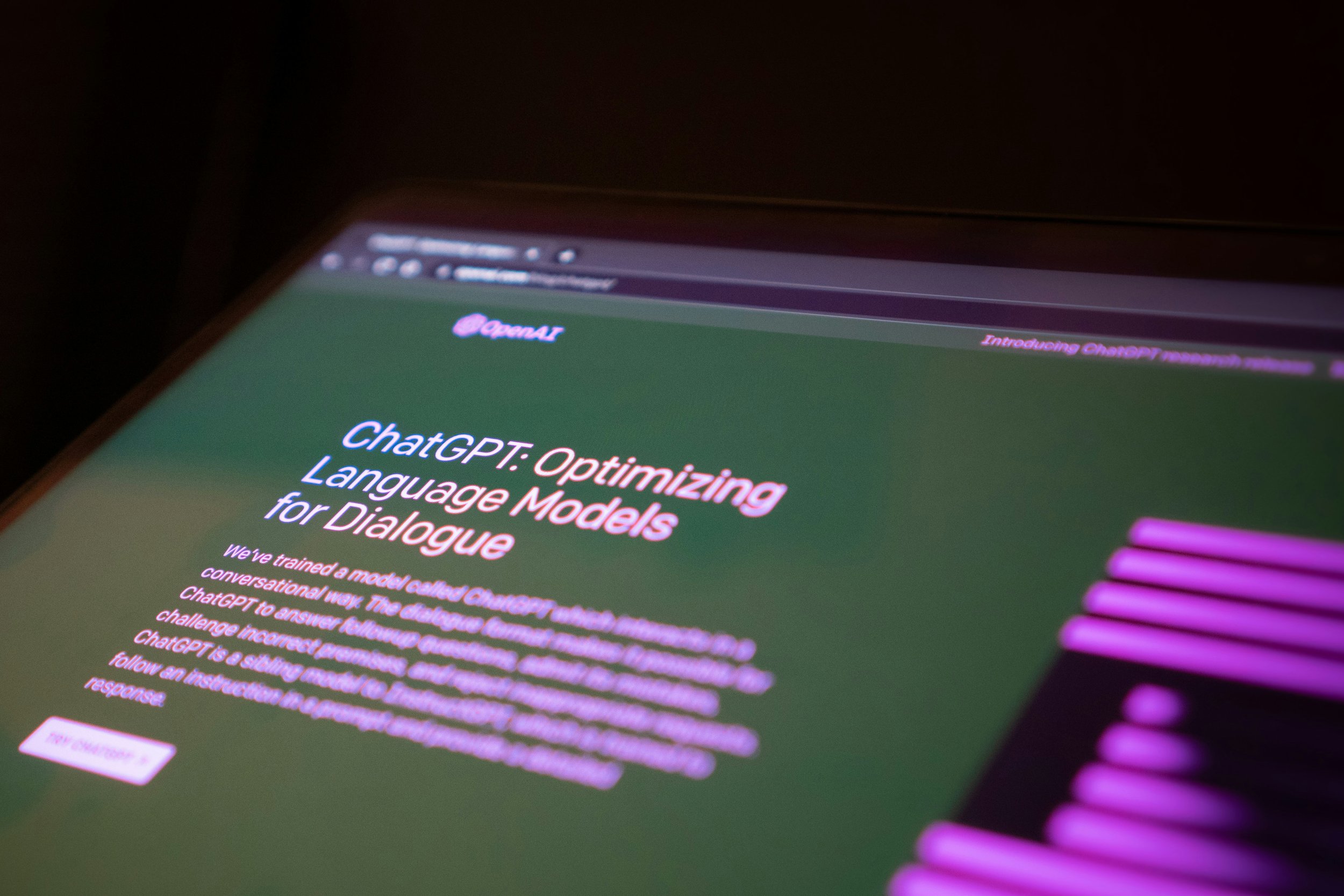

What's new with ChatGPT 4o

OpenAI's latest update to GPT-4 includes vision capabilities, extended memory, enhanced safety measures, improved coding assistance, and higher message limits for Plus users, broadening its application and ensuring safer, more effective use.

#OpenAI #GPT4Update #GPT4Turbo #AI #CodingAssistance #AIethics #ChatGPT #TechUpdate

What exactly is climate fintech?

Climate fintech merges technology and sustainability, attracting $2.3 billion in 2023 despite broader fintech downturns, highlighting its potential and resilience in supporting eco-friendly initiatives.

Keywords:

#ClimateFintech #GreenFintech #SustainableInvesting #ESG #CarbonMarkets #EnergyManagement #InvestmentTrends #DigitalTechnologies #EnvironmentalSustainability #VentureCapital

BOXABL's ADU Approval Boosts California Housing Options

BOXABL secures a pivotal approval for its Casita model in California, promising swift and eco-friendly housing solutions amidst a severe housing shortage.

#BOXABL #CaliforniaHousingCrisis #ADU #SustainableHousing #InvestorInsight #FinancialTransparency #SECReporting #HousingMarketTrends #VentureCapital #RealEstateInnovation

Mastercard's Role in Sustainable Consumption

Ellen Jackowsky, Mastercard’s Chief Sustainability Officer, discusses the role of payment processors in reducing carbon emissions and highlights Mastercard's strategic initiatives and consumer trends driving sustainability in the financial sector.

Keywords: #EllenJackowsky #Mastercard #Sustainability #ClimateChange #InvestmentOpportunities #VentureCapital #PaymentProcessing #EnvironmentalImpact #ConsumerBehavior #TechInnovation

Addepar helps RIA Targeting Digital Assets and Private Markets

Addepar is advancing its technology and expanding its influence in wealth management, now targeting digital assets and private markets to meet the demands of a new investor generation.

#Addepar #WealthManagement #DigitalAssets #PrivateMarkets #InvestmentTechnology #FinancialInnovation #RIA #BobPisani #TechLeadership #AssetManagement