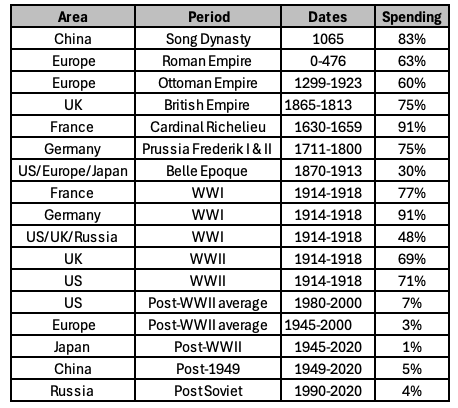

2000 Years of Defense Spending

Defense spending as a share of national output has played a critical role in shaping civilizations, empires, and modern nations. Analyzing the table and graph highlights key historical periods where defense consumed substantial portions of economies and identifies trends in defense spending as a measure of military priorities across eras.

Key Observations

1. High Military Spending in Pre-Modern Eras

• Song Dynasty (China, 1065): Defense spending reached an astonishing 83%, underlining the Song Dynasty’s heavy focus on military infrastructure and territorial protection.

• Roman Empire (Europe, 0–476): Defense consumed 63% of economic output, reflecting the importance of maintaining vast territories and defending borders.

• Ottoman Empire (1299–1923): Consistently spent 60% of resources on defense, crucial for managing expansion and securing frontiers.

2. Military Spending Peaks in Early Modern Europe

• Cardinal Richelieu’s France (1630–1659): Allocated 91% to defense during periods of political consolidation and European conflicts.

• Prussia (1711–1800): Military-oriented society under Frederik I and II spent 75% of GDP, showcasing Prussia’s military focus in Europe.

3. Modern Warfare: Increased Defense Spending During World Wars

• World War I:

• France (77%), Germany (91%), UK (69%), and the US (71%) devoted enormous resources to sustain wartime efforts.

• World War II:

• Similar trends persisted, with the US at 71%, UK at 69%, and Europe collectively at 48%.

4. Post-World War Decline

• After WWII, global defense spending as a percentage of GDP dramatically declined.

• Post-WWII (1945–2000):

• US averaged 7%, Europe 3%, and Japan just 1%, reflecting a shift toward economic rebuilding and peacetime priorities.

5. Modern Trends: Stable and Low Defense Priorities

• China (Post-1949): Allocated just 5% post-revolution, despite modern geopolitical tensions.

• Russia (Post-Soviet Era): Defense spending dropped to 4%, showcasing resource constraints post-USSR collapse.

Broader Insights

1. Historical Focus on Defense:

• The data shows that defense spending historically constituted the largest share of GDP during periods of expansion, empire-building, and large-scale warfare.

2. Shift Toward Economic Development:

• The post-WWII era demonstrates a significant transition from military dominance to economic development and social spending.

3. Current Trends in Strategic Spending:

• With global spending averaging below 10% in the modern era, nations prioritize efficiency in defense budgets while leveraging technological advancements.

Current Defense Sector Opportunity

The defense sector is experiencing significant growth due to escalating global security threats. NATO countries have increased their defense spending commitments in response to rising geopolitical risks, which aligns with AMERICA 2030’s focus on U.S.-based defense companies. Defense spending across NATO countries is projected to rise by 30-50%, driven by heightened national security needs and military readiness requirements. This environment presents potential investment opportunities in dual-use technologies that enhance NATO’s operational capabilities. Key geopolitical risks driving global defense investment include:

Increasing regional conflicts.

Rising cyber and hybrid threats.

Strategic competition among global powers.

The Evolving Nature of Defense

Modern warfare is increasingly characterized by advancements in electronic warfare, autonomous systems, and artificial intelligence. As former Google CEO Eric Schmidt observed, “The future of war is electronic warfare and automated drones powered by artificial intelligence,” highlighting the shift toward AI-enabled technologies.

Geopolitical Drivers

Global defense spending is expected to rise as governments address increasing geopolitical tensions in Eastern Europe, the Middle East, and the Asia-Pacific region. The growing military assertiveness of China, combined with broader regional instability, is driving rearmament cycles among NATO members, European nations, and U.S. allies in Asia. These factors, along with shifts in U.S. foreign policy and trade dynamics, are contributing to global fragmentation, influencing the defense, energy, and security sectors.

Market Growth Projections

The global defense market is projected to grow from $573.5 billion in 2023 to $780.8 billion by 2028, reflecting a compound annual growth rate (CAGR) of 6.4%. Similarly, the aerospace and defense sector are forecast to expand from $884 billion in 2023 to $985.56 billion in 2024, achieving an 11.5% CAGR. (Sources: Yahoo Finance, MENAFN).

Emerging defense technologies such as AI-enabled systems, unmanned vehicles, and directed energy weapons are advancing rapidly. Many of these technologies are expected to reach operational maturity within the next 5 to 10 years. For instance, the U.S. Department of Defense is testing AI-controlled fighter jets and autonomous combat systems, signaling their potential near-term integration into military operations. (Source: Business Insider).

Competitive Landscape

The defense sector is shaped by a mix of established contractors and emerging innovators:

Large Defense Contractors: Companies such as Lockheed Martin, Boeing, and Raytheon continue to dominate the industry, supported by large government contracts and global defense programs.

Emerging Startups: Companies like Anduril and Shield AI are gaining traction with cutting-edge innovations in autonomous systems and AI-enabled platforms.

Cybersecurity: Increasing cyber threats from state and non-state actors are driving demand for advanced encryption, AI-driven threat detection, and defensive cyber technologies.

Space Defense: The militarization of space is becoming a strategic priority, with investments in satellite defense, hypersonic technology, and directed energy weapons.

Technology Trends

Emerging technologies are reshaping the defense landscape, offering significant opportunities for growth:

Unmanned for Multi-Domain Operations: Autonomous systems capable of operating across land, air, and sea are increasingly vital for modern defense strategies.

Robotic and Machine Solutions for Soldier Augmentation: These systems are designed to operate in hazardous environments, reducing personnel risks while enhancing mission success.

Artificial Intelligence: AI applications include real-time threat detection, decision-making optimization, and enhancing autonomous system capabilities.

Directed Energy Weapons: Laser-based systems and electromagnetic railguns are advancing rapidly, offering precision targeting with reduced costs.

Advanced Materials: Innovations in lightweight and durable materials, such as nanomaterials and composites, enhance the performance and protection of vehicles, armor, and aircraft.

Linking Defense Spending Trends to Investment Opportunities

The defense industry has evolved into a dynamic sector, blending traditional military needs with cutting-edge technologies. This is where AMERICA 2030 offers a unique advantage to investors. By focusing on U.S.-based defense companies and high-growth technologies, AMERICA 2030 enables investors to capitalize on the momentum created by increased global defense spending and emerging innovations. Through strategic investments, AMERICA 2030 supports America’s resilience while aligning with global trends in military modernization and geopolitical stability.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies. Join us.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.