Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

Gun-Based C-UAS: Leaders, Technologies, and Opportunities

Drone threats across air, land, and sea—especially Group 1–3 multirotors, FPV kamikaze drones, and loitering munitions—demand layered counter-UAS defense. Gun-based airburst systems offer low-cost, scalable protection. Ukraine’s battlefield accelerates C-UAS innovation now shaping NATO doctrine.

18 Uprounds, 1 Listing, over $7 billion of fresh capital: Why AMERICA 2030’s Strategy Is Delivering Results

In just over a quarter into 2025, AMERICA 2030 has witnessed a remarkable confirmation of its investment thesis: 18 companies in our deal pipeline have already raised follow-on rounds at higher valuations, and Kodiak Robotics just announced a public listing via SPAC. This rapid validation highlights that we are picking the right companies at the right time—positioned at the intersection of defense, energy, security, and AI—at attractive secondary prices before broader capital catches up.

The U.S.-China AI Race: An Ecosystem Problem, Not Just a Technology Gap

We discuss two key sectors of the America 2030 fund that are connected with China.

China’s rapid industrialization is not just about manufacturing dominance—it’s about building an entire ecosystem that supports AI, from infrastructure to energy. With six times the U.S.‘s electrical grid expansion in 2023 alone, China is laying the foundation to dominate AI. This isn’t just a technology race; it’s a systemic shift.

2000 Years of Defense Spending

Explore 2000 years of defense spending trends, from ancient empires like the Song Dynasty and Roman Empire to modern post-WWII nations. This analysis reveals how military priorities have shaped economies and geopolitical strategies.

Betting on America Is the Winning Strategy for Investors

The U.S. stock market, driven by "animal spirits" and S&P 500 global exposure, remains the ultimate investment choice. Learn why historical data and expert insights, including Stanley Druckenmiller's comments, reinforce America's consistent market dominance.

#USMarkets #SP500 #Investing #StanleyDruckenmiller #AnimalSpirits #VanguardData #StockMarketPerformance #GlobalExposure #DollarStrength #JohnBogle #AmericanEconomy #InvestorProtections #StableRegulation #EmergingMarkets #MarketAnalysis

In Plain Sight, No Longer Invisible: Europe at a Crossroad

Europe's reliance on external powers for security, energy, and trade is unraveling, exposing vulnerabilities. IPO CLUB highlights investment opportunities in defense (Natilus) and energy (Newcleo) as critical to bridging the gap with global power blocs.

Automation and Technology Transforming Modern Warfare: The Future of Defense

Exploring the dual-use potential of AI models like Grok, ChatGPT, and Gemini in defense: from real-time data analysis and intelligence gathering to training simulations, each AI offers unique capabilities that could enhance military operations if adapted with ethical safeguards.

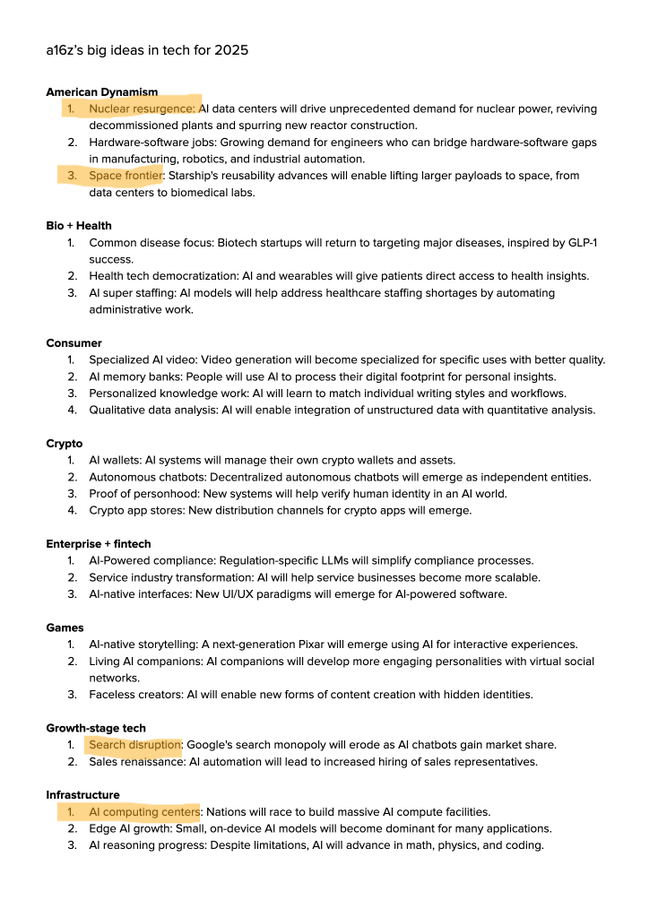

Trend Is Your Friend: Tech’s Biggest Ideas for 2025

AMERICA2030’s portfolio reflects a commitment to shaping the future through investments in critical technologies. From nuclear energy and reusable rockets to AI-disrupting search and custom computing hardware, we provide unparalleled exposure to the technologies driving America’s industrial renewal.

OpenAI and Palantir Join Forces with Anduril to Revolutionize Defense AI

Silicon Valley giants OpenAI and Palantir partner with defense-tech leader Anduril to advance AI in military applications. Focus areas include counter-drone systems and secure data structuring for national security.

#OpenAI #Palantir #Anduril #DefenseAI #CounterDroneSystems #CUAS #GenerativeAI #AIinDefense #NationalSecurity #Anthropic #xAI #SamAltman #TechPartnerships #ArtificialIntelligence #DefenseInnovation #GenerativeAIMarket

Think Outside the Boxes: Rethinking the VC Playbook for AI Investment

Most VC firms invest in the same well-trodden paths of the AI value chain, from applications to hardware. But IPO CLUB sees opportunity in the overlooked fundamentals — electricity, data, communication infrastructure, and more. Learn why thinking outside the boxes drives better returns.