Flexport stock 2024 outlook

Flexport has set ambitious targets for 2024 with plans to significantly boost Revenue and reduce operating expenses amidst a challenging freight market.

The company aims to increase its net revenue to 330 million, surpassing its current annualized figure of under 100 million. Net revenue is the amount that customers pay Flexport for shipping arrangements minus the cost paid to other companies for transporting the goods. CEO Ryan Peterson has returned to lead the company and is focusing on revitalizing sales teams to offset the impact of declining freight rates, which have affected the industry.

Additionally, Flexport plans to cut its operating expenses to below $500 million in 2024, which may require further cost reductions from the company's recent actions:

Flexport layoffs

Flexport's strategic moves, including the layoffs of 20% of its workforce, are part of a broader plan to streamline operations and focus on core competencies. Flexport seeks to enhance its operational efficiency and customer service capabilities by trimming its workforce, even while integrating Convoy's technology. These measures are expected to contribute to a more agile and responsive business model, which is essential in the highly competitive and dynamic freight market. The company's commitment to reducing operating expenses while aiming for a significant increase in net revenue reflects a calculated approach to navigating the challenges in the global shipping industry and positioning itself for sustainable growth.

Flexport and Convoy

Flexport's acquisition of Convoy's technology assets for around $16 million marks a strategic enhancement of its digital freight network. This move is set to strengthen Flexport's technological infrastructure, enabling it to offer more robust and integrated logistics solutions. The acquisition allows Flexport to leverage Convoy's advancements in trucking technology, which could improve operational efficiencies, reduce empty miles, and contribute to Flexport's commitment to sustainability in the logistics sector. By assimilating Convoy's tech, Flexport can further optimize its service offerings, potentially leading to better asset utilization and an improved customer experience in the supply chain ecosystem. Read more here.

For more coverage about Flexport ipo, subscribe to our club letter

Flexport and Shopify

Flexport's collaboration with Shopify represents a strategic move to enhance the logistics capabilities of e-commerce businesses. By integrating Flexport's advanced freight forwarding and customs brokerage services with Shopify's extensive e-commerce platform, the partnership aims to streamline the supply chain process for online retailers. This integration allows Shopify merchants to access more efficient shipping options, better tracking of their goods, and potentially lower shipping costs. This collaboration is particularly beneficial for small to medium-sized businesses that struggle with the complexities of international shipping. Through this partnership, Flexport and Shopify are addressing a critical need in the e-commerce sector, offering a more seamless and efficient logistics solution to help businesses grow and compete in a global marketplace.

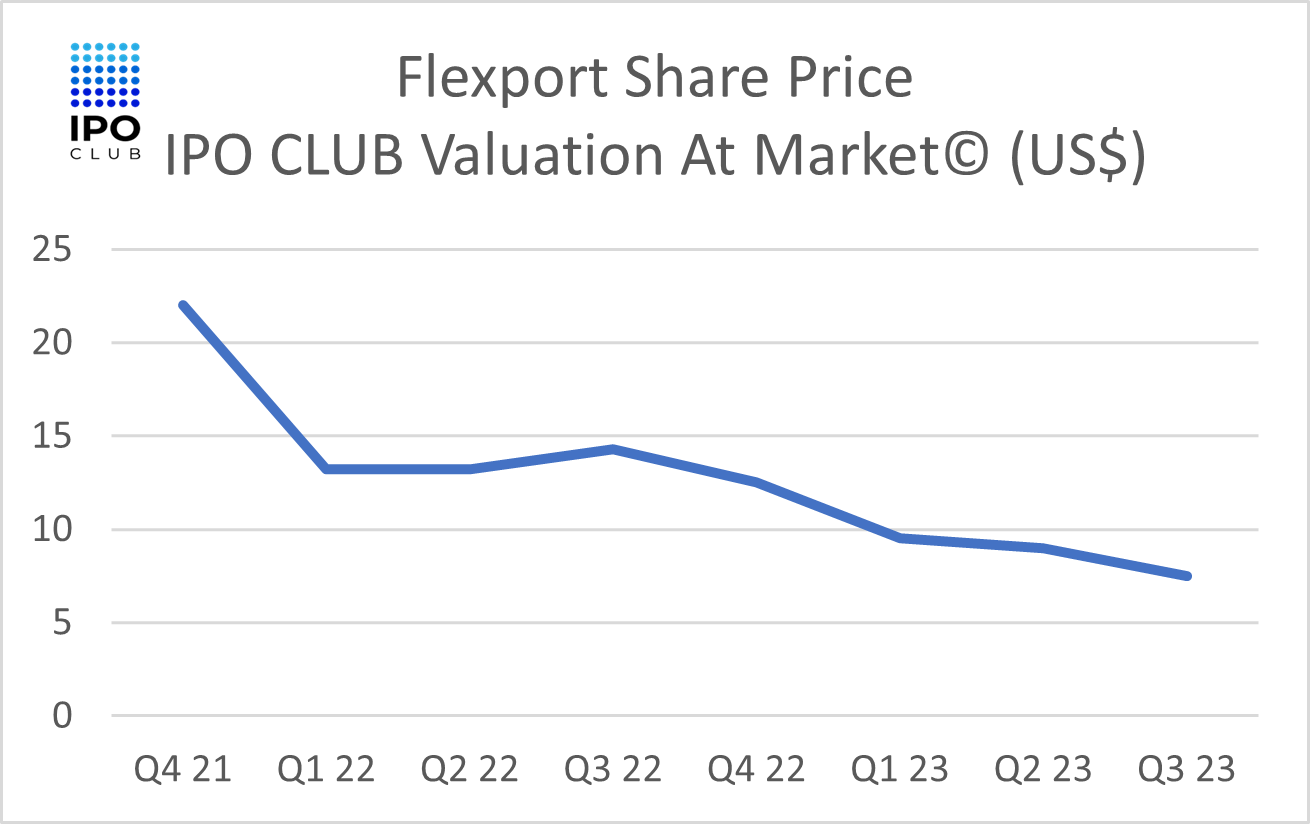

Flexport stock price

Flexport implied secondary market valuation is 2.1 billion dollars down 73% from its March 2022 $8bn round.

Who owns Flexport?

On top of CEO Ryan Petersen, Prominent investors have also played a pivotal role, leading substantial funding endeavors for Flexport. These investors include well-known entities such as:

- Andreessen Horowitz

- Michael Dell

- SoftBank Vision Fund

- MSD Partners

In a notable strategic exchange, the e-commerce giant Shopify (NYSE: SHOP) divested its logistics arm to Flexport, receiving an approximate 13% equity share in return. This trade underscores the interconnected nature of investment and operational strategy in the tech and logistics sectors.

How to Buy Flexport Stock

Flexport is a privately held company, so its stock is unavailable on public exchanges. However, Accredited, qualified, and institutional investors can buy pre-IPO Flexport shares by becoming members of IPO CLUB

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.