LATEST NEWS ON PRE IPO COMPANIES

Follow the news on the most interesting pre ipo companies.

Mario Draghi’s report And Unlocking Europe’s Venture Capital Potential

Europe’s venture capital market faces critical challenges, from fragmented markets to underdeveloped capital ecosystems. With only 5% of global VC funding, European startups often relocate to the U.S. for better access to capital. IPO Club’s experience reflects these dynamics, highlighting the need for market reforms to retain innovation, talent, and funding within Europe.

#VentureCapital #EuropeanStartups #TechInnovation #CapitalMarkets #InvestmentStrategy #ScalingInnovation #MarioDraghi #StartupEcosystem #PrivateEquity #USInvestments #GlobalEconomy #Entrepreneurship #FinancialMarkets

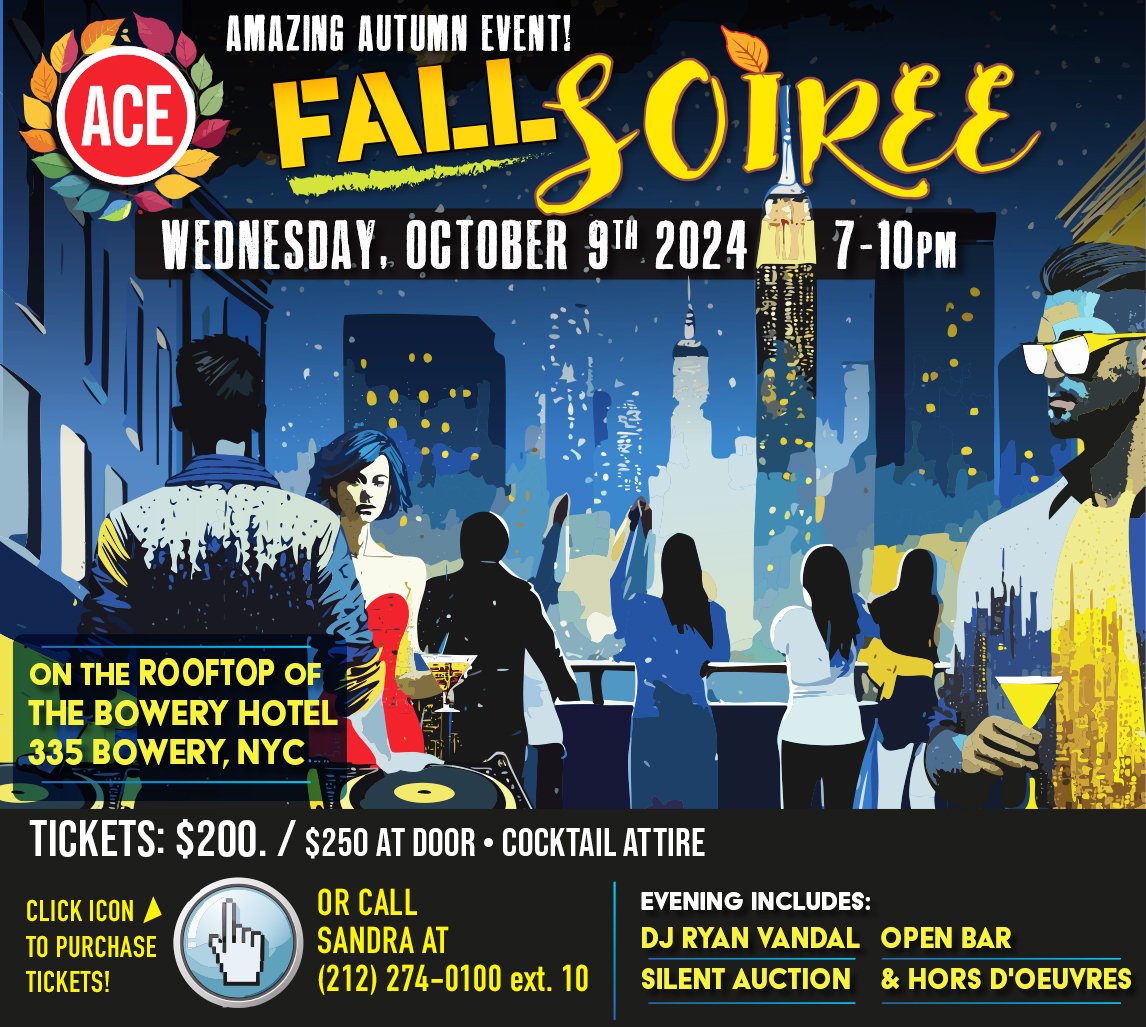

ACE fall event in NEW YORK

Join ACE’s Fall Soirée on October 9, 2024, for a chic night on The Bowery Hotel Rooftop in NYC, featuring live music, an open bar, hors d’oeuvres, and a silent auction.

#ACEFallSoirée #NYCEvents #TheBoweryHotel #Fall2024 #RooftopParty #NYCNightlife #OpenBar #DJRyanVandal #CocktailAttire

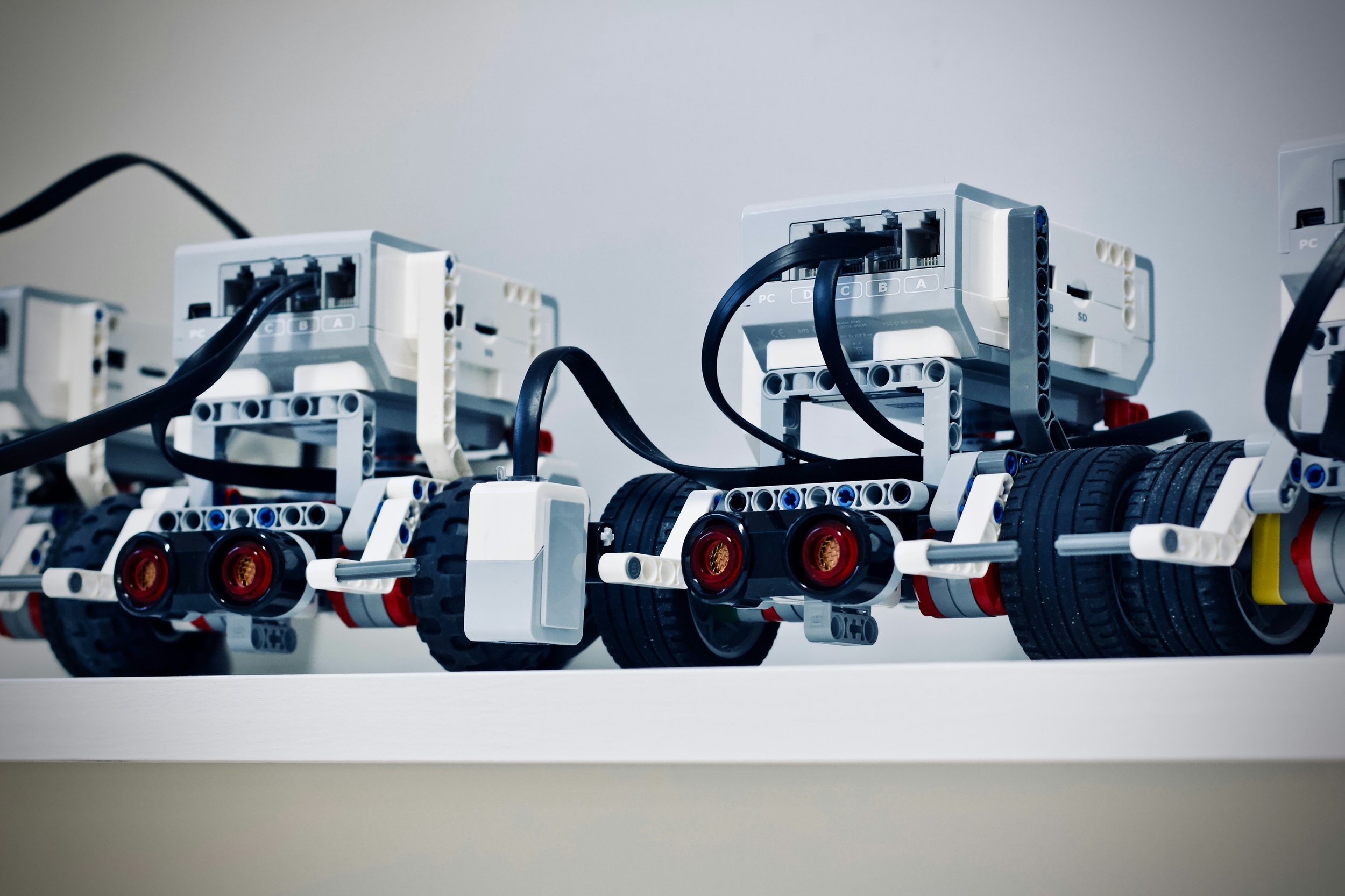

Investing in Robotics

Robotics startups have struggled commercially despite significant innovation. Challenges include high R&D costs, technical difficulties, and market saturation. While success stories like Kiva Systems exist, failures have been more common due to difficult economics, margin compression, and integration challenges.

#robotics #startups #innovation #KivaSystems #R&D #margins #commercialization #technology #automation #techindustry #investing #venturecapital #marketchallenges

VC Investment in AI

The influx of capital into AI reflects broader venture trends, demanding returns that stretch plausibility. With $125B invested annually, VCs must achieve 3x returns. Expect volatility in secondaries as supply increases and discounts become more pronounced.

#VentureCapital #AICapital #SecondaryMarkets #LimitedPartners #MarketVolatility #InvestmentReturns #VC #NetAssetValue #InvestmentStrategy

Venture Capital Thematic Investing: Risks and Pitfalls

Focusing too much on trendy investment themes in venture capital can lead to inefficiencies and suboptimal returns. The best investments often lie outside predefined theses, offering less competition and higher potential.

Venture capital, Canva, startup funding, innovation, Melanie Perkins, AirBnB, WhatsApp, SpaceX, Dropbox, investment challenges, design software, entrepreneurial success.

Pre-IPO stocks Q2 update

In Q2 2024, venture capital activity remains robust with heightened liquidity and stabilized trade volumes around $10M, despite a slight dip from Q1 peak levels. Significant transactions over $50M are resurfacing, indicating strong investor confidence.

#VentureCapital #Q22024 #MarketAnalysis #InvestorBehavior #TradeVolumes #Liquidity #ActiveBuyers #Investment #FinancialMarket

Private Markets Q2 Report (so far)

Upcoming IPOs to watch in 2024 include Databricks, Cerebras, Circle, Klarna, Skims, Monzo, and Fanatics. These companies are set to impact the tech and fintech sectors significantly.

#IPO #PreIPO #Databricks #Cerebras #Circle #Klarna #Skims #Monzo #Fanatics #TechIPO #Fintech #Investment #StockMarket

Why We Love Venture Capital

Venture capital offers unmatched excitement and opportunities by investing in early-stage companies. Understanding psychology, corporate culture, and macroeconomic trends is crucial for navigating this dynamic field.

Keywords: #VentureCapital #InvestmentStrategy #CorporateCulture #Macroeconomics #InterestRates #Inflation #ContrarianInvesting #Agility #LongTermVision

IPO Market pergnant with tech companies.

Discover the vibrant lineup of tech companies ready to debut on the stock market in 2024. From Rubrik and Plaid to Stripe.

Explore how these enterprises are poised to energize the IPO scene despite fluctuating valuations and market conditions.

Keywords: #TechIPOs2024 #DiscordIPO #RedditIPO #ChimeIPO #KlarnaValuation #StripeIPO #CerebrasAI #Stripe #Plaid #Rubrik #VentureBackedCompanies #IPOMarketTrends #StockMarket2024

Dismissed Distributions?

Venture capital’s allure has always been rooted in its promise of outsized returns, derived from the successful incubation and maturation of groundbreaking startups. Yet, there's an emerging narrative that reveals a critical oversight in the venture capital saga: the Dismissed Distributions.

ACE NEW YORK $5,000,000 Capital Campaign supported by IPO CLUB.

IPO CLUB proudly supports the Association of Community Employment Programs for the Homeless (ACE), a distinguished 501(c)(3) nonprofit organization committed to transforming lives in New York City. Since 1992, ACE has provided job training, education, and support services to the homeless, aiding their journey toward economic independence and societal reintegration.

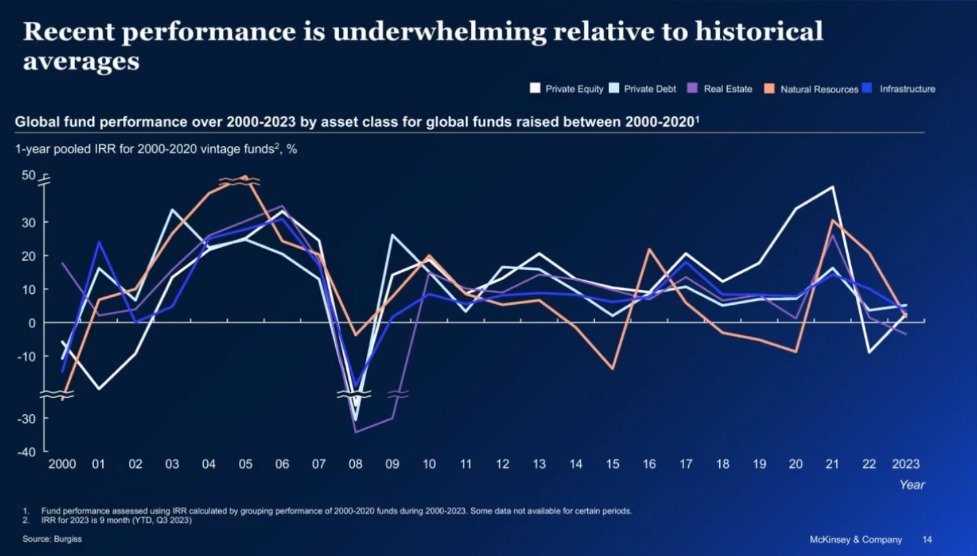

Venture Capital and Private Equity in 2023

Unveiling the 2023 dynamics of private equity and venture capital markets, this analysis delves into PE's resilience amidst global fundraising challenges and VC's strategic pivot in response to economic headwinds. Gain insights into the sectors' performances, trends, and investment shifts.

Pre-IPO: An X Spaces on investing in digital assets

We were recently featured in an X Spaces about investing in digital assets. Here is an excerpt of the chat. AT IPO CLUB We Provide Performance and Safety in Pre-IPO Investments for Accredited Investors.

Why are secondary valuations not rising?

Valuing a private company involves assessing its total worth (numerator) and the number of shares (denominator). If the company's value increases but shares also rise, the per-share value may not grow, akin to a fraction's dynamics. Reasons for rising shares include capital raising, employee compensation, acquisitions, debt conversion, and investor inclusion. To elevate a private stock's price, focus on revenue growth, profitability, strategic partnerships, market expansion, product innovation, and operational efficiency. Investing in venture stocks within bubbles or momentum carries risks and opportunities, demanding careful analysis, market timing, diversification, and risk management strategies.

Reddit IPO update

Explore the journey of Reddit from its founding to its anticipated IPO, contrasting its growth with giants like Facebook (Meta). Discover how anonymity, user interface, and community engagement shape Reddit's unique market position. Unveil the impact of Reddit's user-driven content on its financial performance and the broader implications of its public offering. Dive into the dynamics of "stonks" and stock trading influenced by Reddit's community actions.

50 Terms You Need To Know In pre-IPO Investing

Navigating the pre-IPO investment landscape requires a deep understanding of specific terminology that underpins the processes, strategies, and legal frameworks involved. This glossary, encompassing 50 crucial terms, serves as a foundational guide for investors aiming to explore opportunities in companies before they become publicly traded. It covers the financial instruments, investor rights, company equity structures, and regulatory considerations essential for making informed decisions and maximizing the potential for returns in the pre-IPO domain.

What shall we build together? Pitch your startup to IPO CLUB.

Unlock the door to your startup's success with IPO CLUB. We're searching for innovative ideas and passionate entrepreneurs ready to transform their visions into reality. We provide more than funding; we offer a partnership to accelerate growth, leverage industry networks, and gain strategic insights. Whether in the early stages or gearing up for scale, IPO CLUB is the platform to propel you forward.

Venture Capital in 2024: Navigating Through Uncertainty to Uncover Growth

In the ever-evolving venture capital landscape of 2024, investors face high-profile departures and a cautious market. Despite these challenges, AI and sustainability tech sectors emerge as beacons of opportunity. This post delves into the current state, trends, opportunities, and strategic moves for VC investors, highlighting the resilience and potential for innovation amidst adversity. With insights from recent reports, it's a must-read for those looking to navigate the complexities of VC investing in 2024. Discover how to leverage economic indicators and sector-specific growth to make informed decisions.

Q4 2023 valuations at market

This analysis provides a nuanced view of each company and vertical's performance, offering valuable insights for strategic decision-making and potential investment directions in the upcoming period.

Q4 2024 valuations and YTD and performance for various portfolio companies across different verticals, here is a detailed report on each company's quarter-over-quarter (QoQ) and year-to-date (YTD) and insights into vertical trends.