Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

How to become an accredited investor

How to become an accredited investor?

An accredited investor is an individual or institution that has earned special status to invest in unregulated securities such as pre-IPO and venture funds.

To qualify as an accredited investor, you must meet certain qualifications, such as being a high earner or having a net worth of $1 million.

Unregistered securities are inherently risky but often offer higher rates of return, allowing accredited investors to build wealth quickly.

What is a 401k?

Understanding 401k can be a crucial step towards effective retirement planning and long-term financial stability. This article is designed to explain the basics of 401k and delve into some specifics that can help potential investors in pre-IPO stocks decide how to allocate their contributions towards interesting private companies. It's important to note that this guide is not providing tax or financial advice but is instead a resource to better comprehend your options.

Understanding the Triad of Investing: Stake, Odds, and Prize

For those of us with our sights set on financial growth and prosperity, the investing world never truly goes on vacation. This brings to mind an intriguing parallel between two seemingly distinct activities: investing and gambling. Both fields revolve around three core elements - stake, odds, and prize.

Q2 23 Valuation At Market

The rules for “Valuation at Market©” are based on the IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to certificates of incorporation, limited offering exemption notices, employee plan exemption notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last day of January, April, July, and October.

Seizing Investment Opportunities in the IPO Market: Valuations Trailing Public Market by 30%

In a significant development that echoes the reinvigoration of the IPO landscape, the U.S. IPO market has sprung back to life with the advent of three highly anticipated listings.

Basic Human Needs and Their Impact on private market IPO investing

In light of the profound link between basic human needs and private investing, platforms that adopt this approach stand out as strategic tools for informed investing. One such distinguished platform is IPO.Club. The platform uniquely structures its investment strategies around Maslow's Hierarchy of Needs, giving its users an edge in the private market.

U.S. Recession Update: Assessing the Impact on the Private Market

In a recent interview, renowned investor Stanley Druckenmiller shared his insights on the current economic landscape and the potential for a U.S. recession. With the private market being a key area of interest for investors, we delve into Druckenmiller's observations and their implications for this sector. Let's explore the factors at play and their potential impact on private market dynamics.

Q1 23 Valuation At Market

The rules for “Valuation at Market©” are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to certificates of incorporation, limited offering exemption notices, employee plan exemption notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last day of January, April, July, and October.

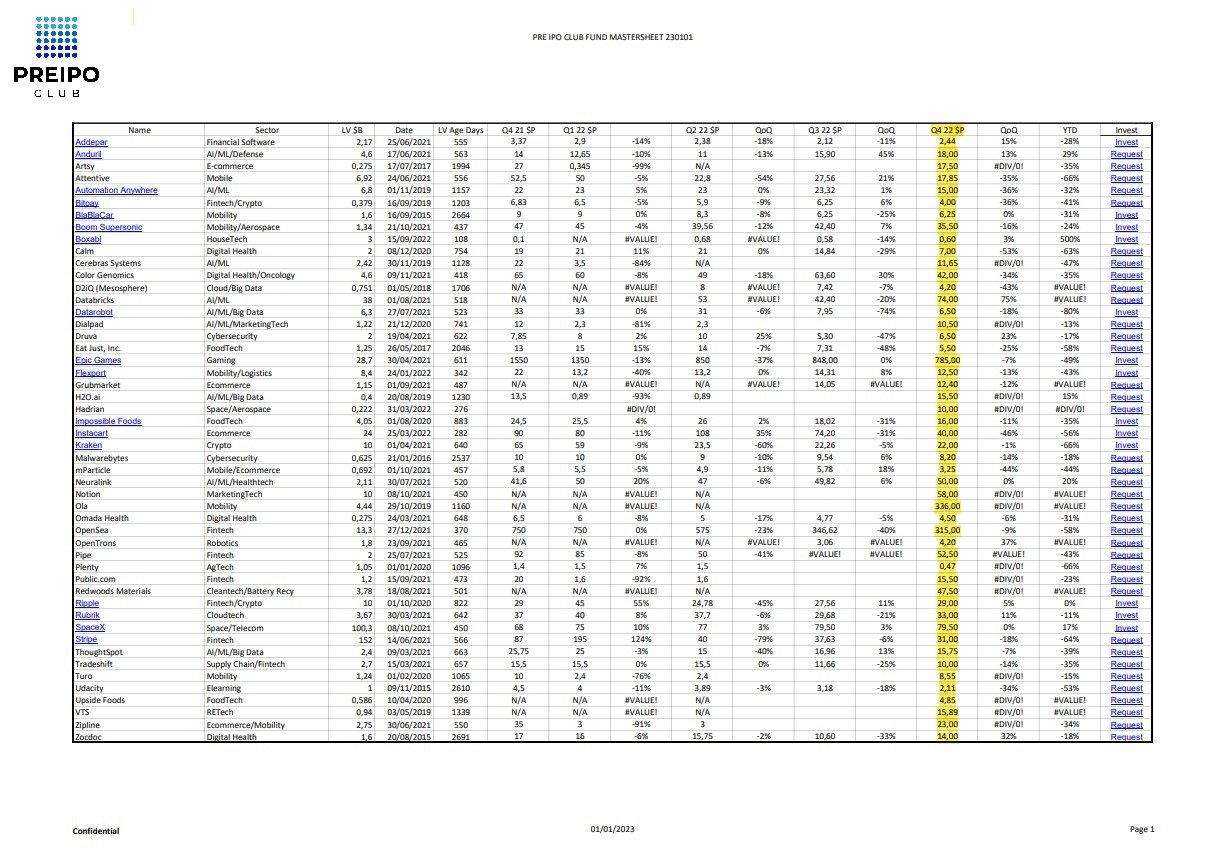

Q4 22 Valuation At Market

The rules for “Valuation at Market©” are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to certificates of incorporation, limited offering exemption notices, employee plan exemption notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last day of January, April, July, and October.