LATEST NEWS ON PRE IPO COMPANIES

follow the news on the most interesting pre ipo companies.

Anduril significant milestones and successes in 2023

Explore the potential of Anduril's stock as the defense tech leader may consider an IPO in the near future. With its innovative approach and substantial growth in 2023, Anduril's move towards public trading could be a game-changer in the defense industry. Stay updated on Anduril IPO developments for investment insights.

NewCleo 2023: Pioneering the Future of Nuclear Energy with Strategic Expansions

Explore NewCleo's transformative 2023 journey in nuclear energy. From raising equity to strategic acquisitions and partnerships shaping the future of sustainable energy. With innovative LFR and MOX fuel technology, NewCleo is poised for significant growth in 2024, eading the charge in environmentally responsible nuclear solutions.

New Year’s wishes for Our Portfolio Companies.

As we enter a new year, we at IPO CLUB are filled with anticipation and high hopes for our portfolio companies. Each has shown remarkable potential and resilience, and we're excited to share our aspirations for their milestones.

GoodData Excellent Year

GoodData experienced a remarkable year marked by significant advancements and recognition. It was acknowledged in the 2023 Gartner for Analytics and Business Intelligence Platforms, showcasing its robust vision and execution capabilities. GoodData also enhanced its cloud platform with innovative features like drill-down interactions and dependent filters in dashboards, reinforcing its commitment to data-driven decision-making.

2024 pre-IPO investment themes

Explore 2024's top VC investment themes: AI-hardware, pushing boundaries in computational power; Fintech, revolutionizing digital finance and Defense. These sectors promise significant growth and innovation, aligning with long-term capital appreciation goals.

Epic Games wins an epic battle against Google

Epic Games achieved a significant legal victory against Google, as a California jury ruled Google's Play Store practices constituted an illegal monopoly. This decision, following extensive court testimony, marks a pivotal moment in digital marketplace dynamics, potentially reshaping app distribution and in-app purchase systems. The jury's unanimous verdict against Google's monopolistic behavior could herald a new era of competition and innovation in the tech industry.

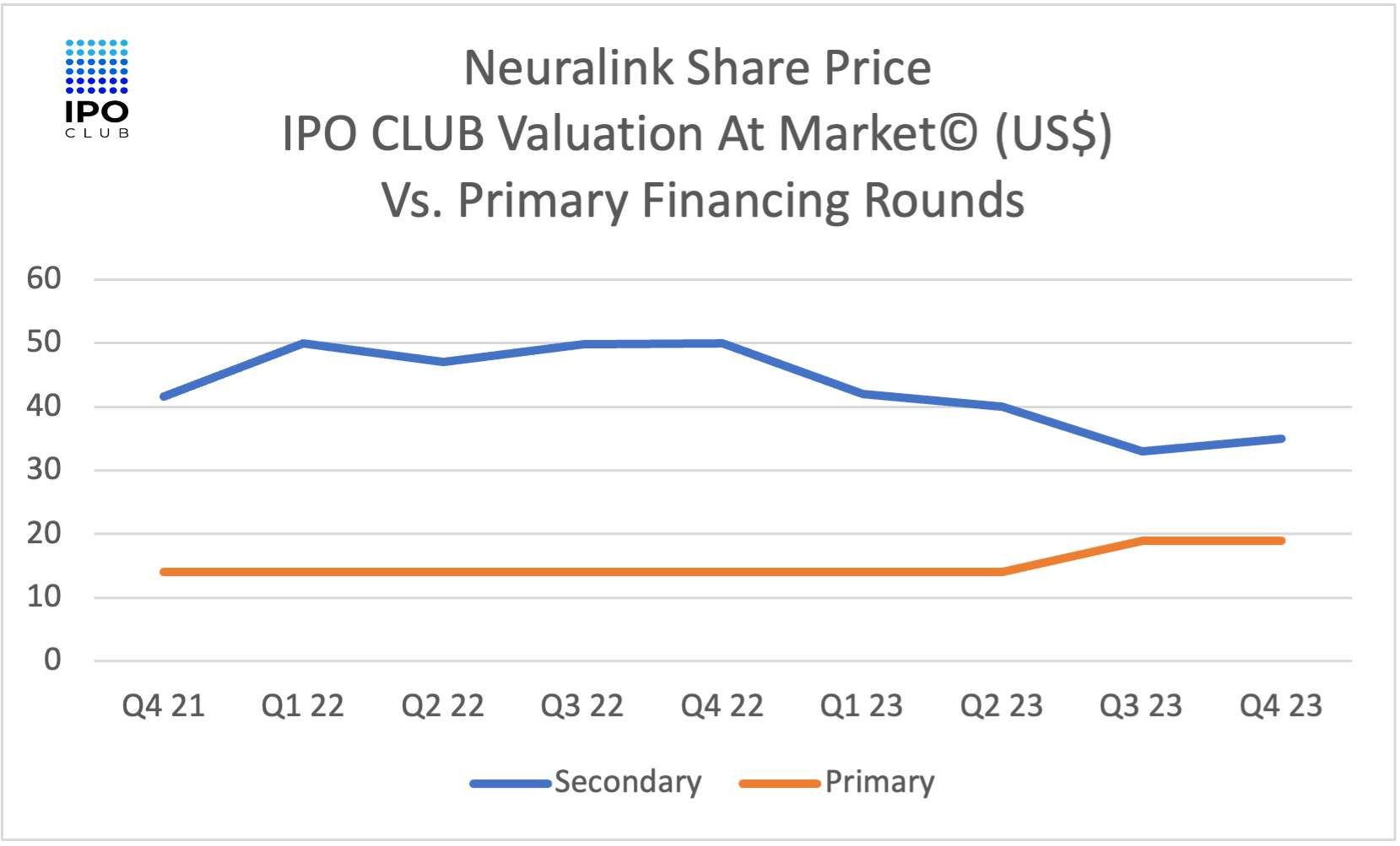

Neuralink stock update

Neuralink, co-founded by Elon Musk, is a leader in the development of brain-machine interfaces. Not publicly traded, it's sought after in secondary markets, often at a premium. In 2022, shares hit $50, contrasting a $15 price per share from the Series C round. A July 2023 VC round priced shares at just over $19, with recent secondary market trades above $30, suggesting a narrowing valuation gap for early investors. This reflects the company's strong performance and the increasing valuation benchmarks in recent funding rounds.

Automation Anywhere's New AWS Partnership

Explore the partnership between Automation Anywhere and AWS as they innovate in automation for enterprise growth. This alliance could redefine industry standards and enhance investor portfolios in the private markets sector.

Natilus.co's Pioneering Year: Revolutionizing Air Cargo and Defense with Innovative BWB Aircraft

In 2023, Natilus.co dramatically advanced air cargo with its Kona BWB aircraft. Starting with a significant Ameriflight agreement, totaling $6.8 billion for 460+ aircraft, they then validated Kona's design via successful prototype flights. A key partnership with ZeroAvia aimed for zero-emission propulsion, while expansion into defense showcased autonomous capabilities for varied missions, reflecting Natilus' commitment to transforming logistics and defense sectors.

Pre-IPO strategies for December and Q1 2024

Explore "Strategic Venture Capital Investment Approaches" for Dec and Q1 2024. Highlighting Momentum strategy with companies like OpenAI and SpaceX, Deep Value with DataRobot and Epic Games, and Quick Exit strategy featuring Ripple and Rubrik, this guide delves into smart investment moves for upcoming financial quarters.

November sanity check

November Sanity Check delves into the latest private market trends, offering a portfolio manager's perspective on the month's performance. We analyze key decisions, market shifts, and emerging opportunities, providing insights into our strategic choices and their impact on your investments. This month's review is crucial for understanding market dynamics and our approach to navigating them, ensuring informed decisions and optimal outcomes for our Members.

Crypto Market Bounces Back

The overall trend for the cryptocurrency market in November 2023 was upward, indicating a recovery phase with increased market capitalization, positive momentum across various cryptocurrencies, and increased investor engagement.

Impossible Foods stock update Q4 2023

In a challenging alternative meat market, Impossible Foods stands out with growth in U.S. retail, defying a sector downturn. Notably, their Impossible Beef Lite has received American Heart Association certification, emphasizing health benefits with 75% less saturated fat than lean beef, 21g of protein, and vital micronutrients. This aligns with consumer health trends, bolstering Impossible Foods' market position amidst broader category struggles.

Automation Anywhere Announces Strong Third Quarter FY24

Automation Anywhere's third-quarter success, marked by a 35% increase in large deal values, showcases the impact of its GenAI-enhanced products. With over 50% of bookings from deals over $100,000, the company's growth in North America, APJ, India, and the Middle East is notable. CEO Shukla credits GenAI solutions for 30% of bookings, highlighting their role in solving complex challenges and driving profitability.

Kraken charged by the sec.

The SEC has charged Kraken for operating an unregistered crypto trading platform. Kraken allegedly merged exchange, broker, dealer, and clearing agency roles without SEC registration, neglecting vital investor protections. The SEC's legal action seeks to ensure compliance with securities laws, safeguarding investor interests in the evolving crypto industry.

OpenAI Turmoil: Investor Legal Challenge Amidst Leadership Crisis

OpenAI faces a leadership crisis following the ousting of CEO Sam Altman, sparking potential mass employee resignations and investor legal action. Investors fear significant losses in the generative AI leader, while the company's unique structure complicates their recourse.

Ripple Update thanksgiving 2023

Ripple and XRP are redefining global payments, notably with their recent expansion into Africa and beyond through a partnership with Onfariq. This move has led to a significant increase in XRP's market cap, reflecting growing confidence in Ripple's network for efficient cross-border transactions. Ripple's innovative approach, leveraging XRP as a bridge currency and securing critical regulatory milestones, positions it as a leader in transforming international financial transfers.

How DataRobot's AI Innovation Shapes the Future of Business

DataRobot CEO Debanjan Saha emphasizes trust in AI, advocating for a culture that drives innovation with a clear mission, risk-taking, and data-driven decision-making.

Epic Games' Legal Clash with Google

Epic Games, the powerhouse behind Fortnite, is confronting Google in court over app marketplace fees. As Epic v. Google unfolds, the stakes are high; the verdict could redefine digital commerce. Our pre-IPO platform offers a unique chance to invest in Epic Games' bold challenge before they go public, potentially capitalizing on the company's push for market transformation.

#EpicGames #IPOAnalysis #StockTrends

AI Hardware and Systems: Cerebras or SambaNova Systems?

Explore the competitive landscape of AI hardware: Cerebras and SambaNova's valuations suggest high growth expectations, while NVIDIA, AMD, and Intel's varying multiples paint a diverse picture of investor sentiment, emphasizing the value in lower multiples.